For the 24 hours to 23:00 GMT, the EUR declined 0.29% against the USD and closed at 1.1174.

Data showed that, in the Eurozone, seasonally adjusted trade surplus narrowed to €17.9 billion in March, driven by higher imports and following a surplus of €19.5 billion in the previous month. Market participants had expected trade surplus to narrow to €19.0 billion.

The US dollar rose against the Euro yesterday, on the back of robust economic data.

Separately, in the US, data showed that housing starts registered a rise of 5.7% to an annual rate of 1235.0K in April, compared to a revised reading of 1168.0K in the prior month. Additionally, building permits advanced 0.6% to an annual rate of 1296.0K in April. Building permits had recorded a revised reading of 1288.0K in the prior month. Further, seasonally adjusted initial jobless claims fell to a level of 212.0K in the week ended 11 May 2019, more than market expectations for a fall to a level of 221.0K. Initial jobless claims had recorded a level of 228.0K in the prior week. Moreover, the Philadelphia Fed manufacturing index recorded a more-than-expected rise to 16.6 in May, amid rise in the shipments index. In the prior month, the index had recorded a level of 8.5.

In the Asian session, at GMT0300, the pair is trading at 1.1179, with the EUR trading marginally higher against the USD from yesterday’s close.

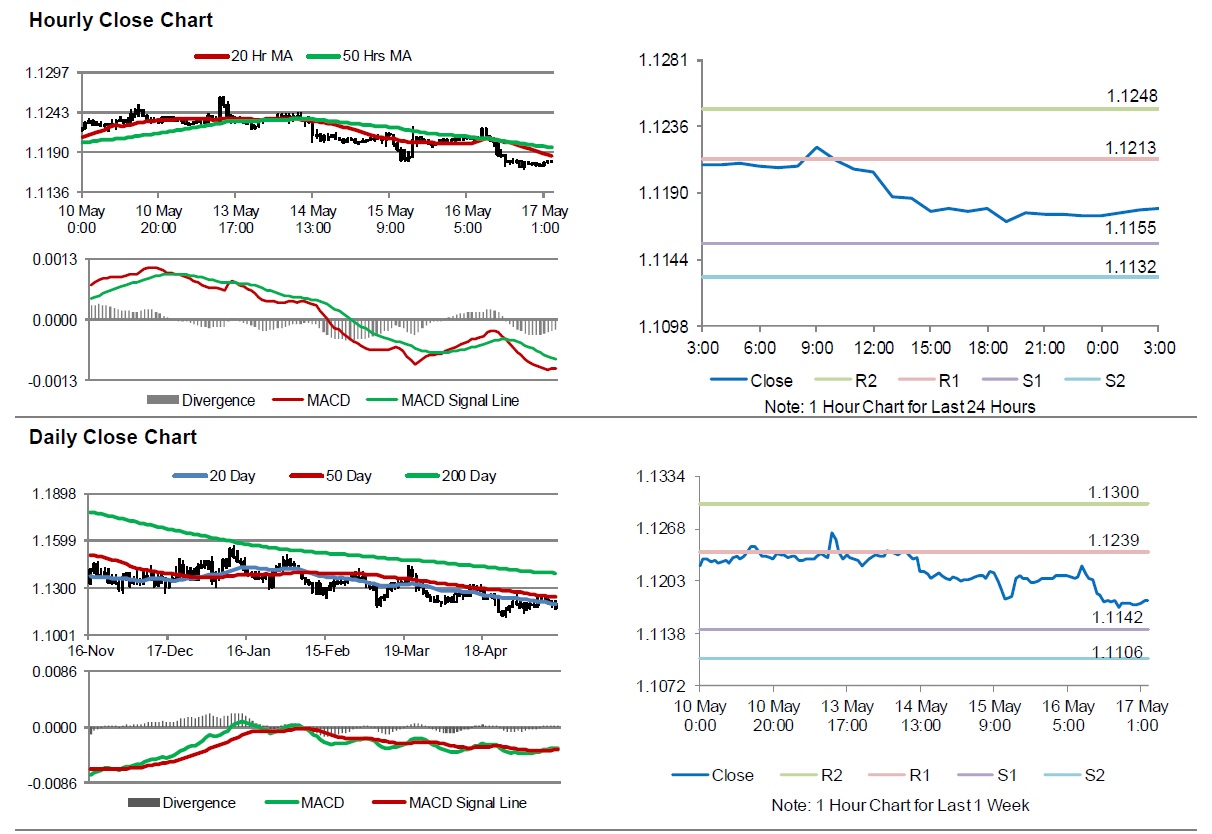

The pair is expected to find support at 1.1155, and a fall through could take it to the next support level of 1.1132. The pair is expected to find its first resistance at 1.1213, and a rise through could take it to the next resistance level of 1.1248.

Looking ahead, traders would keep a close watch on the Euro-zone’s consumer price index for April and construction output for March, slated to release in a few hours. Later in the day, the US leading index for April and the Reuters/Michigan consumer sentiment index for May, will keep investors on their toes.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.