For the 24 hours to 23:00 GMT, the EUR rose 0.07% against the USD and closed at 1.1324.

In the economic news, the Euro-zone’s seasonally adjusted trade surplus narrowed to €13.4 billion in September, compared to a revised surplus of €16.8 billion in the prior month. Market participants had expected the nation to post a surplus of €16.3 billion.

In the US, data showed that the US NY Empire State manufacturing index unexpectedly advanced to a level of 23.3 in November, defying market consensus for a fall to a level of 20.0. In the previous month, the index had recorded a reading of 21.1. Moreover, the nation’s advance retail sales rebounded 0.8% on a monthly basis in October, rising by the most in five months and following a revised drop of 0.1% in the prior month. Markets were anticipating advance retail sales to climb 0.5%. Moreover, business inventories climbed 0.3% on a monthly basis in September, meeting market consensus. In the previous month, business inventories had recorded a gain of 0.5%.

On the other hand, the nation’s Philadelphia Fed manufacturing index declined to a level of 12.9 in November, more than market expectations for a fall to a level of 20.0. The index had registered a level of 22.2 in the preceding month. Additionally, the US seasonally adjusted initial jobless claims surprisingly increased to a level of 216.0K in the week ended 10 November 2018, confounding market expectations for a drop to a level of 213.0K. In the preceding week, initial jobless claims had registered a level of 214.0K.

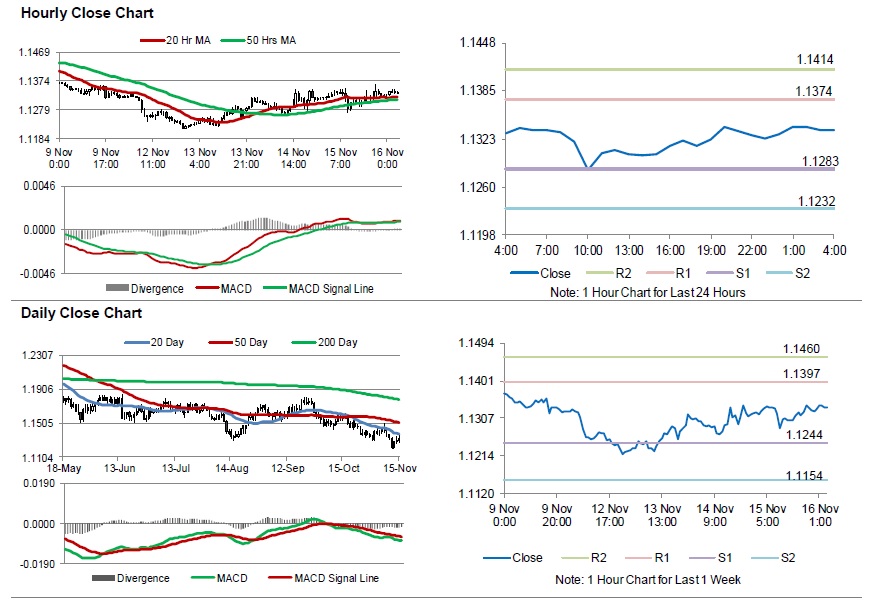

In the Asian session, at GMT0400, the pair is trading at 1.1335, with the EUR trading 0.10% higher against the USD from yesterday’s close.

The pair is expected to find support at 1.1283, and a fall through could take it to the next support level of 1.1232. The pair is expected to find its first resistance at 1.1374, and a rise through could take it to the next resistance level of 1.1414.

Going ahead, investors would closely monitor the European Central Bank President, Mario Draghi’s speech followed by the Euro-zone’s consumer price index for October, due in a few hours. Later in the day, the US industrial production and manufacturing production, both for October, will keep traders on their toes.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.