For the 24 hours to 23:00 GMT, the EUR declined 0.55% against the USD and closed at 1.1629 on Friday,

On the data front, the Euro-zone’s seasonally adjusted trade surplus narrowed to a level of €12.8 billion in July, marking its lowest level in 4 years and more than market consensus for a surplus of 16.2 billion. In the previous month, the nation had posted a revised surplus of €16.5 billion.

The US dollar gained ground against a basket of currencies, following upbeat economic data.

In the US, data showed that industrial production climbed 0.4% on a monthly basis in August, rising for the third consecutive month and compared to a revised similar rise in the prior month. Market participants had anticipated industrial production to rise by 0.3%. Moreover, the nation’s Reuters/Michigan flash consumer sentiment index advanced to a six-month high level of 100.8 in September, compared to a reading of 96.2 in the previous month. Markets had envisaged the index to rise to a level of 96.6. Business inventories sharply rose 0.6% on a monthly basis in July, at par with market expectations. In the previous month, business inventories had advanced 0.1%. Meanwhile, manufacturing production rose 0.2% on a monthly basis in August, undershooting market expectations for a rise of 0.3%. In the previous month, manufacturing production had recorded a gain of 0.3%. Additionally, advance retail sales rose 0.1% on a monthly basis in August, reflecting its slowest progress in six months and less than market expectations for a rise of 0.4%. Advance retail sales had increased by a revised 0.7% in the preceding month.

In the Asian session, at GMT0300, the pair is trading at 1.1636, with the EUR trading 0.09% higher against the USD from Friday’s close.

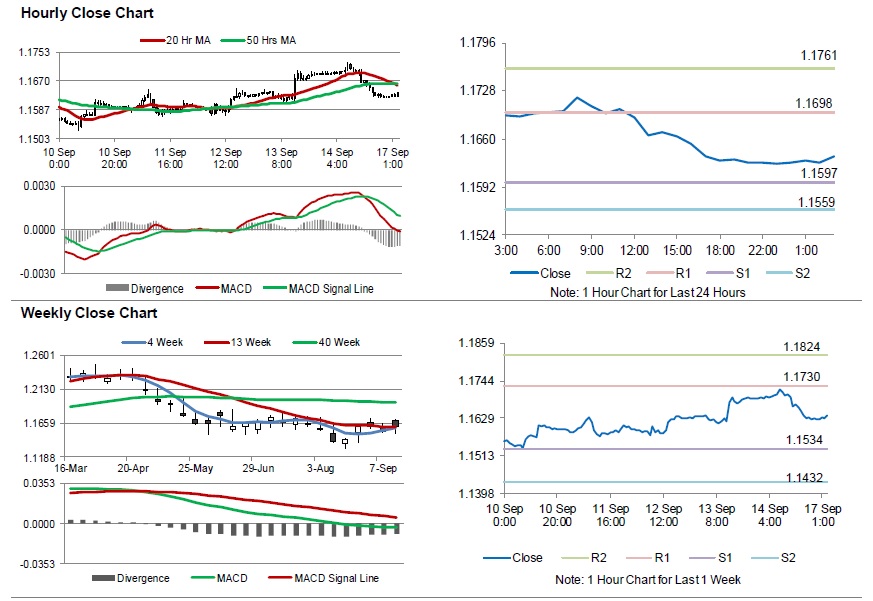

The pair is expected to find support at 1.1597, and a fall through could take it to the next support level of 1.1559. The pair is expected to find its first resistance at 1.1698, and a rise through could take it to the next resistance level of 1.1761.

Moving ahead, traders will closely monitor the Euro-zone’s consumer price index for August, set to release in a few hours. Later in the day, the US Empire manufacturing index for September, will keep investors on their toes.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.