For the 24 hours to 23:00 GMT, the EUR declined 0.28% against the USD and closed at 1.0741 on Friday.

On the macro front, the Euro-zone’s seasonally adjusted trade surplus narrowed more-than-expected to a level of €15.7 billion in January, compared to market expectations for the nation’s trade surplus to narrow to a level of €22.0 and following a revised surplus of €23.1 billion in the prior month. Moreover, the nation’s seasonally adjusted construction output fell 2.3% MoM in January. In the previous month, construction output had registered a revised drop of 0.6%.

Meanwhile, the European Central Bank (ECB) policymaker, Ewald Nowotny, stated that the ECB will decide later whether to raise interest rates before or after ending its bond purchase programme, thus hinting that an interest rate hike could be on the cards by year end.

Macroeconomic data revealed that the US flash Reuters/Michigan consumer sentiment index climbed more-than-anticipated to a level of 97.6 in March, compared to a reading of 96.3 in the previous month, while market participants anticipated for a rise to a level of 97.0. Further, the nation’s leading indicator surged to its highest level in more than a decade, after it increased more-than-expected by 0.6% in February, compared to a similar rise in the previous month. Additionally, the nation’s manufacturing production registered a rise of 0.5% in February, meeting market expectations and advancing for the sixth consecutive month, suggesting that recovery in the manufacturing sector was gathering speed as rising commodity prices boost demand for machinery and other equipment. In the prior month, manufacturing production had registered a revised similar rise.

Meanwhile, the nation’s industrial production remained flat in February, confounding investor consensus for a rebound of 0.2%, as unseasonably warm weather again dragged down utilities. In the prior month, industrial production had registered a revised drop of 0.1%.

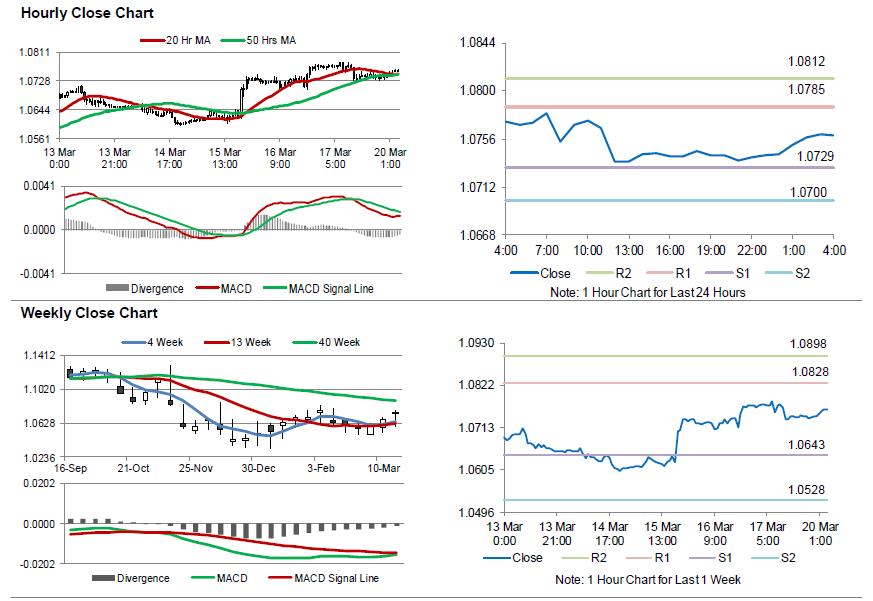

In the Asian session, at GMT0400, the pair is trading at 1.0759, with the EUR trading 0.17% higher against the USD from Friday’s close.

The pair is expected to find support at 1.0729, and a fall through could take it to the next support level of 1.0700. The pair is expected to find its first resistance at 1.0785, and a rise through could take it to the next resistance level of 1.0812.

Moving ahead, investors will look forward to Germany’s producer price index for February, slated to release in a few hours. Moreover, the US Chicago Fed national activity index for February, will also be closely watched by market participants.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.