For the 24 hours to 23:00 GMT, the EUR rose 0.09% against the USD and closed at 1.2339 on Friday.

On the economic front, the Euro-zone’s seasonally adjusted trade surplus unexpectedly widened to €21.0 billion in February, while investors had envisaged the region’s trade surplus to remain steady at a revised level of €20.2 billion registered in the preceding month.

Separately, Germany’s final consumer price index (CPI) grew 1.6% on an annual basis in March, confirming the preliminary print. The CPI had recorded an advance of 1.4% in the prior month.

The US Dollar fell against a basket of major currencies on Friday, after the US flash Reuters/Michigan consumer sentiment index fell to a 3-month low level of 97.8 in April, more than market expectations for a fall to a level of 100.4, as consumers fretted over the possible consequences of a heated global trade war on the US economy. The index had recorded a level of 101.4 in the prior month. Moreover, the nation’s JOLTs job openings declined less-than-anticipated to a level of 6052.0K in February, compared to a revised level of 6228.0K registered in the previous month. Market participants had expected job openings to fall to a level of 6024.0K.

In the Asian session, at GMT0300, the pair is trading at 1.2340, with the EUR trading slightly higher against the USD from Friday’s close.

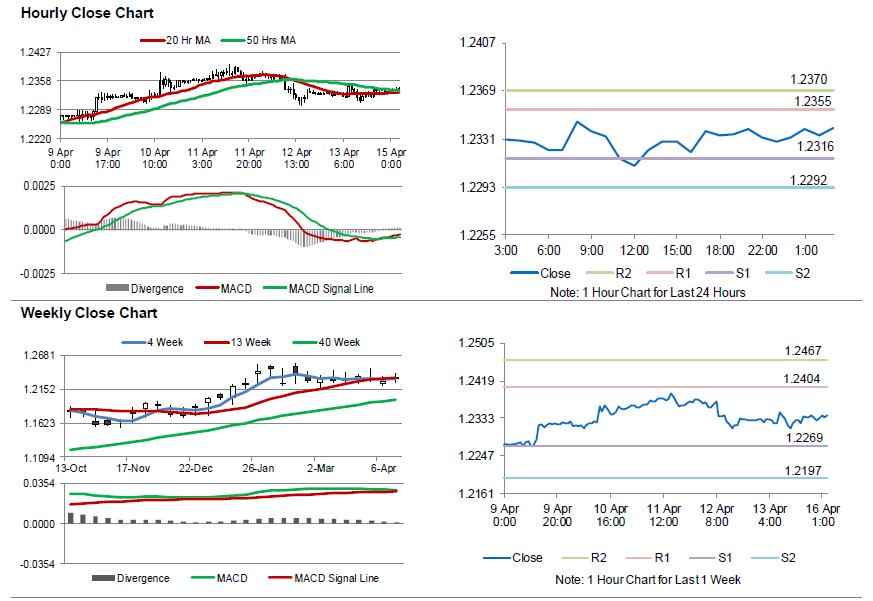

The pair is expected to find support at 1.2316, and a fall through could take it to the next support level of 1.2292. The pair is expected to find its first resistance at 1.2355, and a rise through could take it to the next resistance level of 1.2370.

Amid a lack of key macroeconomic releases in the Euro-zone today, investors will direct their attention to the US retail sales for March, NAHB housing market index for April and business inventories data for February, all due to release later in the day.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.