For the 24 hours to 23:00 GMT, the EUR declined 0.28% against the USD and closed at 1.1935, shrugging off upbeat economic releases across the Euro-bloc.

Data revealed that the unemployment rate in the Euro-zone declined to a nearly 9-year low level of 8.7% in November, meeting market expectations and reflecting an enduring labour market growth. Unemployment rate had recorded a level of 8.8% in the previous month.

Separately, Germany’s seasonally adjusted industrial production accelerated by the most in over 8 years, after rebounding 3.4% on a monthly basis in November, suggesting that the industrial sector is likely to gain strength in the coming months. Markets had expected industrial production to advance 1.8%, after recording a revised drop of 1.2% in the previous month. Also, the nation’s seasonally adjusted trade surplus widened more-than-anticipated to €23.7 billion in November, after recording a surplus of €18.9 billion in the previous month, as growth in exports outpaced that of imports. Market participants were anticipating the nation to post a trade surplus of €21.3 billion.

In the US, data revealed that the NFIB small business optimism index surprisingly eased to a level of 104.9 in December, confounding market expectations for an advance to a level of 107.8. The index had registered a reading of 107.5 in the prior month. On the other hand, the nation’s JOLTs job openings unexpectedly slid to a level of 5879.0K in November, hitting a 6-month low level, defying market consensus for a rise to a level of 6025.0K. JOLTs job openings had registered a revised reading of 5925.0K in the previous month.

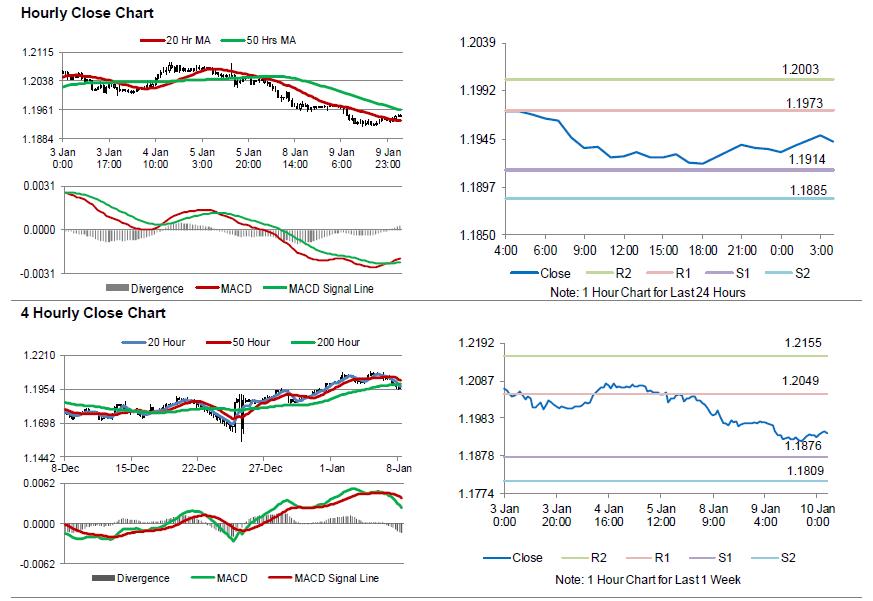

In the Asian session, at GMT0400, the pair is trading at 1.1942, with the EUR trading 0.06% higher against the USD from yesterday’s close.

The pair is expected to find support at 1.1914, and a fall through could take it to the next support level of 1.1885. The pair is expected to find its first resistance at 1.1973, and a rise through could take it to the next resistance level of 1.2003.

In absence of any crucial macroeconomic releases in the Euro-zone today, investors would look forward to the US MBA mortgage applications data followed by the nation’s import and export price indices, both for December, slated to release later in the day.

The currency pair is trading between its 20 Hr and 50 Hr moving averages.