For the 24 hours to 23:00 GMT, the EUR marginally rose against the USD and closed at 1.1743.

On the macro front, the Euro-zone ZEW survey economic sentiment index climbed to 64.0 in August, more than market forecast for a rise to a level of 59.9 and compared to a reading of 59.6 in the prior month. Additionally, Germany’s ZEW survey economic sentiment index unexpectedly rose to 71.5 in August, defying market expectations for a drop to a level of 58.0 and compared to a reading of 59.3 in the previous month. Meanwhile, the ZEW survey current situation unexpectedly dropped to -81.3 in August, confounding market forecast for a rise to a level of -68.8 and compared to a reading of -80.9 in the earlier month.

In the US, the producer price index rose 0.6% on a monthly basis in July, recording its largest increase since October 2018 and more than market consensus for a rise of 0.3%. In the previous month, the index had recorded a drop of 0.2%. Meanwhile, the NFIB business optimism index unexpectedly declined to 98.8 in July, defying market expectations for a rise to a level of 105.9 and compared to a reading of 100.6 in the earlier month.

In the Asian session, at GMT0300, the pair is trading at 1.1722, with the EUR trading 0.18% lower against the USD from yesterday’s close.

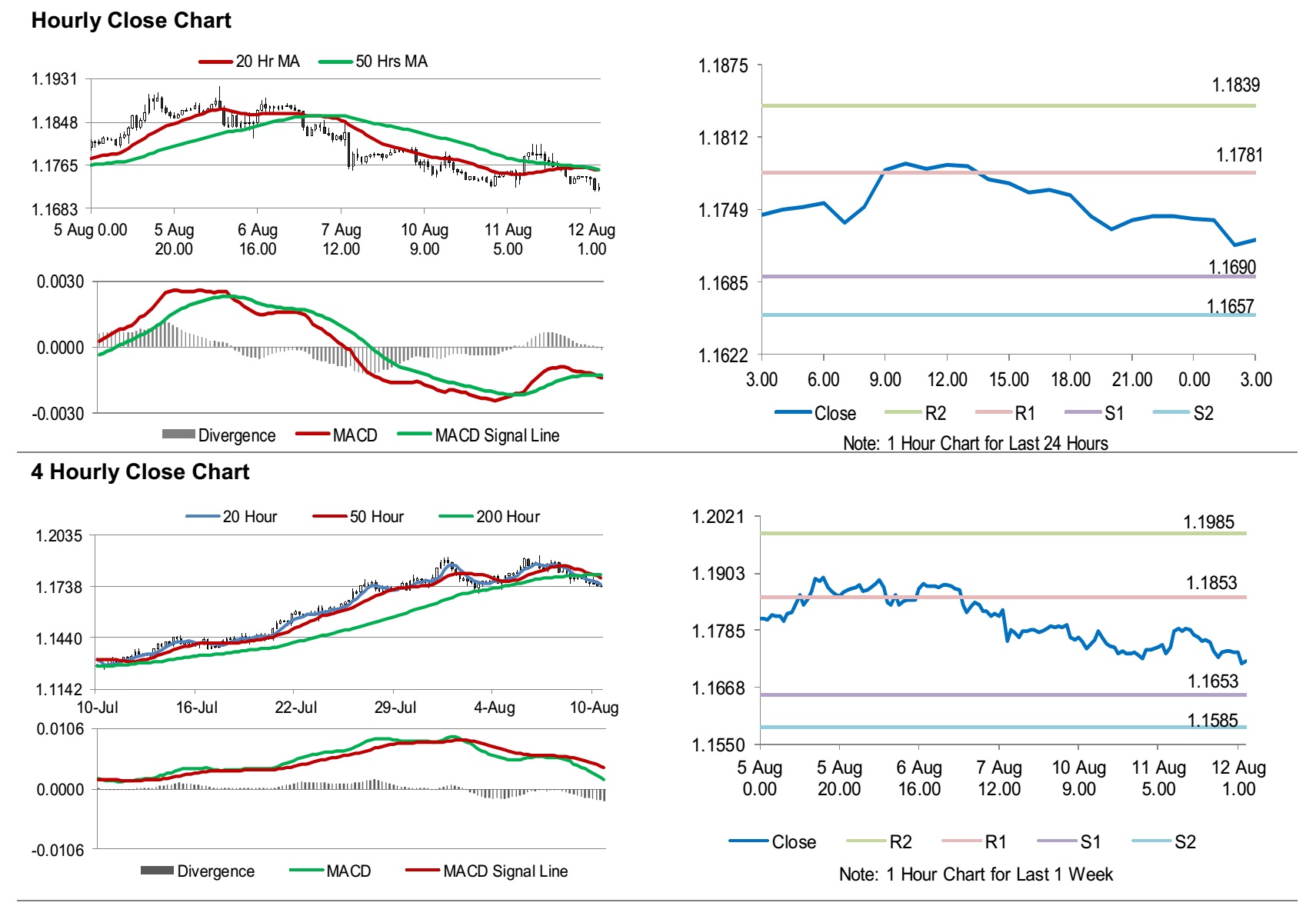

The pair is expected to find support at 1.1690, and a fall through could take it to the next support level of 1.1657. The pair is expected to find its first resistance at 1.1781, and a rise through could take it to the next resistance level of 1.1839.

Moving ahead, traders would keep a watch on Euro-zone’s industrial production for June, slated to release in a few hours. Later in the day, the US consumer price index and monthly budget statement, both for July, along with the MBA mortgage applications, would keep investors on their toes.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.