For the 24 hours to 23:00 GMT, the EUR declined 0.57% against the USD and closed at 1.1261.

On the macro front, Euro-zone’s ZEW survey economic sentiment index climbed to 58.6 in June, compared to a level of 46.0 in the previous month. Separately, Germany’s ZEW survey current situation rose to -83.1 in June, more than market consensus for a rise to a level of -84.0 and compared to a reading of -93.5 in the prior month. Additionally, the ZEW survey economic sentiment advanced to 63.4 in June, surpassing market forecast for a rise to a level of 60.0 and compared to a level of 51.0 in the earlier month.

In the US, retail sales surged 17.7% on a monthly basis in May, more than market expectations for a rise of 8.0% and compared to a revised fall of 14.7% in the previous month Moreover, the NAHB housing market index climbed to 58.0 in June, more than market consensus for a rise to a level of 45.0 and compared to a reading of 37.0 in the earlier month. Additionally, manufacturing production advanced 3.8% on a monthly basis in May, compared to a revised drop of 15.5% in the prior month. Meanwhile, industrial production rose 1.4% on a monthly basis in May, less than market forecast for a rise of 2.9% and compared to a revised fall of 12.5% in the previous month. Also, business inventories fell 1.3% in April, compared to a revised decline of 0.3% in March.

Separately, the US Federal Reserve Chairman Jerome Powell, during his testimony before the Senate Committee on Banking, Housing, and Urban Affairs, maintained a cautious stance about the economy. He stated that the levels of output and employment remain far below their pre-pandemic levels, and “significant uncertainty” remains about the timing and strength of the recovery.

In the Asian session, at GMT0300, the pair is trading at 1.1263, with the EUR trading marginally higher against the USD from yesterday’s close.

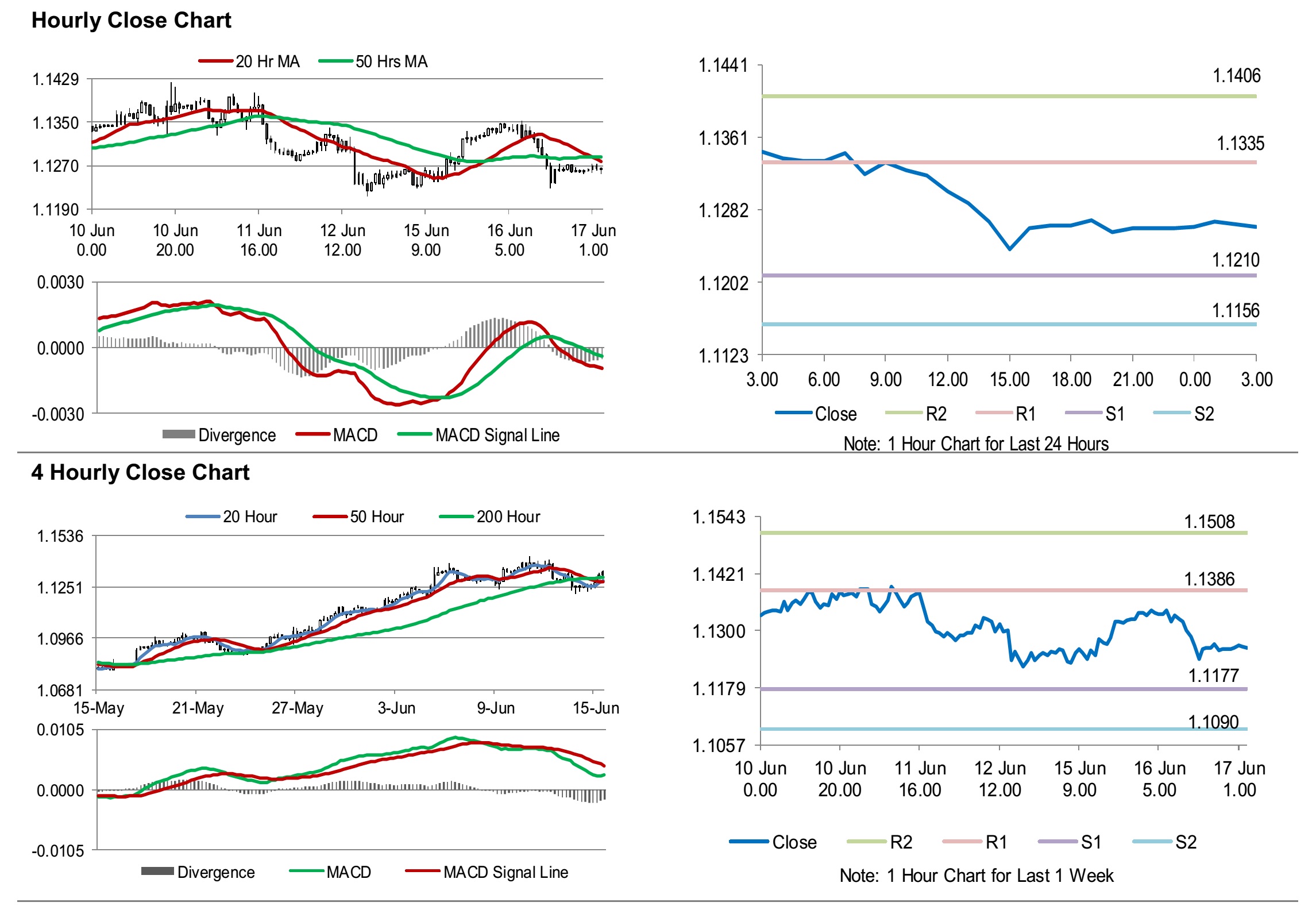

The pair is expected to find support at 1.1210, and a fall through could take it to the next support level of 1.1156. The pair is expected to find its first resistance at 1.1335, and a rise through could take it to the next resistance level of 1.1406.

Moving ahead, traders would keep a watch on Euro-zone’s consumer price index for May and construction output for April, slated to release in a few hours. Later in the day, the US building permits and housing starts, both for May along with the MBA mortgage applications would keep investors on their toes.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.