For the 24 hours to 23:00 GMT, the EUR declined 0.74% against the USD and closed at 1.0684, following disappointing German flash inflation figures.

Data indicated that Germany’s flash consumer price index (CPI) advanced less-than-expected by 1.6% on an annual basis in March, easing some pressure on the European Central Bank to wind down its massive monetary stimulus programme soon. The CPI had recorded a rise of 2.2% in the previous month, while market participants expected a gain of 1.8%.

Separately, the Euro-zone’s final consumer confidence index improved to a level of -5.0 in March, meeting market expectations and confirming the preliminary print. In the prior month, the index had registered a level of -6.2.

The greenback traded higher against most of its major counterparts, after the latest data indicated that the US economy grew stronger than initially estimated in the fourth quarter of 2016.

The US annualised gross domestic product (GDP) was revised higher to 2.1% in the fourth quarter of 2016, boosted by robust consumer spending and compared to an advance of 3.5% in the previous quarter. The preliminary figures had indicated an advance of 1.9%, while markets anticipated the nation to grow by 2.0%. Meanwhile, the nation’s initial jobless claims fell to a level of 258.0K in the week ended 25 March 2017, less than market expectations of a fall to a level of 247.0K and following a level of 261.0K in the previous week.

Separately, the Dallas Federal Reserve Bank President, Robert Kaplan, stated that he expects two additional interest rate increases this year.

In the Asian session, at GMT0300, the pair is trading at 1.0679, with the EUR trading marginally lower against the USD from yesterday’s close.

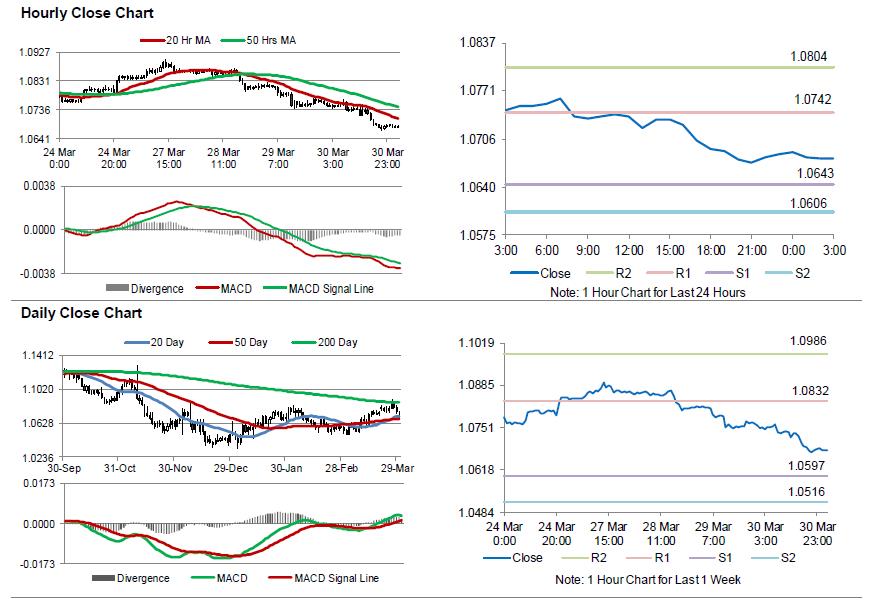

The pair is expected to find support at 1.0643, and a fall through could take it to the next support level of 1.0606. The pair is expected to find its first resistance at 1.0742, and a rise through could take it to the next resistance level of 1.0804.

Moving ahead, investors will keep a close watch on the Euro-zone’s flash consumer price index (CPI) data for March, slated to release later today along with Germany’s unemployment rate and retail sales data, both for March, due in a few hours. Moreover, in the US, final Michigan consumer confidence index for March along with personal spending and income data for February, will be on investor’s radar.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.