For the 24 hours to 23:00 GMT, the EUR rose 1.12% against the USD and closed at 1.1796, boosted by robust economic growth in Germany.

In economic news, second estimate of the Euro-zone’s seasonally adjusted gross domestic product (GDP) climbed 0.6% on a quarterly basis in the third quart of 2017, confirming the preliminary print. The region had registered a revised advance of 0.7% in the prior quarter. Additionally, the region’s ZEW economic sentiment index rose to a level of 30.9 in November, compared to a reading of 26.7 in the prior month. On the contrary, the region’s seasonally adjusted industrial production retreated 0.6% MoM in September, dropping for the first time in three months. Industrial production had climbed 1.4% in the preceding month.

Separately, preliminary data indicated that German economic growth accelerated 0.8% QoQ in the three months to September, outstripping market expectations for an expansion of 0.6%, thus suggesting that the German economy will continue to be a bellwether for growth in the common currency bloc.

Another set of data revealed that mood among German investors improved to a 6-month high in November, after the ZEW economic sentiment index climbed to a level of 18.7, as growth prospects for the economy remain encouragingly positive. However, the index fell short of market expectations for a rise to a level of 19.5, compared to a level of 17.6 recorded in the previous month. Also, the nation’s current situation index jumped to a six-year high level of 88.8 in November. In the prior month, the index had registered a level of 87.0. Further, the nation’s final consumer price index advanced 1.6% on an annual basis in October, in line with the preliminary estimate and following a gain of 1.8% in the previous month.

Macroeconomic data released in the US showed that producer price index (PPI) climbed more-than-expected by 2.8% on an annual basis in October, posting its largest increase since February 2012. Market participants had anticipated the PPI to gain 2.4%, after registering a rise of 2.6% in the prior month.

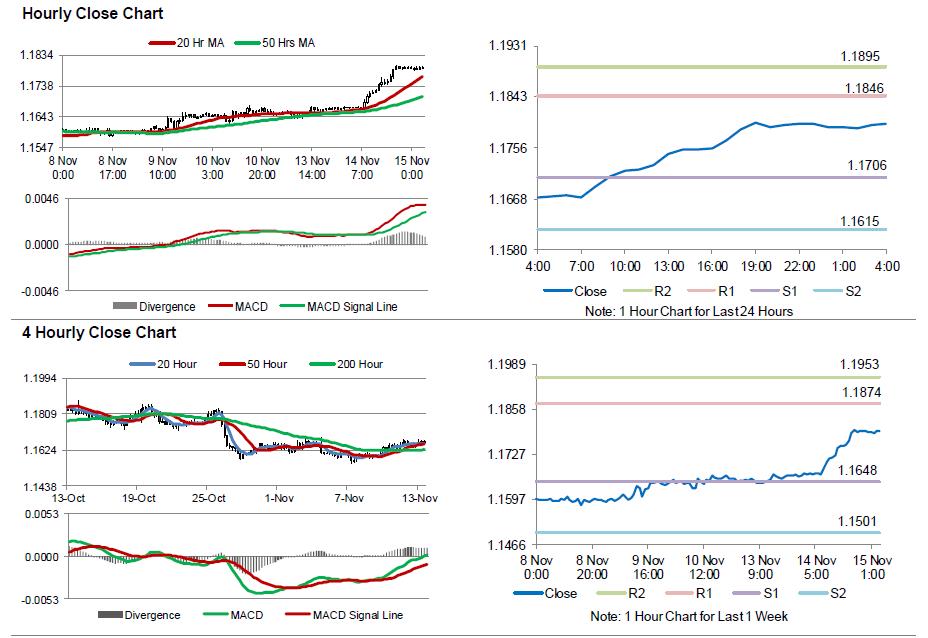

In the Asian session, at GMT0400, the pair is trading at 1.1796, with the EUR trading flat against the USD from yesterday’s close.

The pair is expected to find support at 1.1706, and a fall through could take it to the next support level of 1.1615. The pair is expected to find its first resistance at 1.1846, and a rise through could take it to the next resistance level of 1.1895.

Moving ahead, investors would look forward to the Euro-zone’s trade balance figures for September, slated to release in a few hours. Later in the day, traders would focus on crucial US inflation and retail sales data, both for October.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.