For the 24 hours to 23:00 GMT, the EUR declined 0.39% against the USD and closed at 1.0880.

On the economic front, Germany’s seasonally adjusted trade surplus widened more-than-expected by €25.4 billion in March, as both exports and imports surged to a record high level, thus pointing towards robust overseas and domestic demand. The nation registered a revised surplus of €20.0 billion in the previous month, while markets expected the nation’s surplus to widen to a level of €21.5 billion. Additionally, the nation’s exports rose more-than-anticipated by 0.4% on a monthly basis in March, compared to a revised rise of 0.9% in the previous month. Further, imports sharply rebounded by 2.4% MoM in March, compared to a drop of 1.6% in the previous month.

On the other hand, the nation’s seasonally adjusted industrial production fell 0.4% MoM in March, lower than market expectations for a fall of 0.7%. Industrial production had registered a revised rise of 1.8% in the prior month.

Macroeconomic data released in the US indicated that JOLTs job openings climbed more-than-expected to a level of 5743.0K in March, compared to a revised reading of 5682.0K in the prior month, while investors had envisaged for a rise to a level of 5725.0K. Moreover, the nation’s final wholesale inventories surprisingly climbed 0.2% in March, compared to a drop of 0.1% in the preliminary print. In the prior month, the wholesale inventories had registered a rise of 0.4%. Meanwhile, the nation’s NFIB small business optimism index eased less-than-anticipated to a level of 104.5 in April, compared to a level of 104.7 in the previous month.

In the Asian session, at GMT0300, the pair is trading at 1.0891, with the EUR trading 0.1% higher against the USD from yesterday’s close.

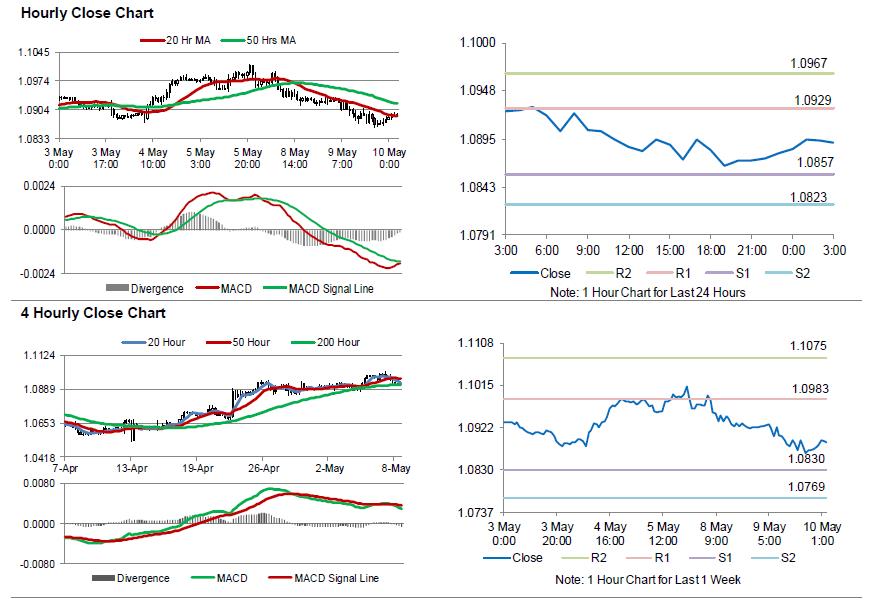

The pair is expected to find support at 1.0857, and a fall through could take it to the next support level of 1.0823. The pair is expected to find its first resistance at 1.0929, and a rise through could take it to the next resistance level of 1.0967.

Going forward, market participants will draw their attention to a speech by the European Central Bank (ECB) President, Mario Draghi, in Dutch Parliament, scheduled in a few hours. Also, the US monthly budget statement for April and MBA mortgage applications data, slated to release later today, will garner significant amount of market attention.

The currency pair is showing convergence with its 20 Hr moving average and trading below its 50 Hr moving average.