For the 24 hours to 23:00 GMT, the EUR rose 0.63% against the USD and closed at 1.1757 on Friday, following upbeat German inflation figures.

Data showed that Germany’s flash consumer price index (CPI) advanced more-than-expected by 1.7% on an annual basis in July, rising to its highest level in 3 months, aided by higher energy prices. Market participants had anticipated the CPI to rise 1.5%, following a gain of 1.6% in the prior month.

Separately, the Euro-zone’s final consumer confidence index dropped to a level of -1.7 in July, confirming the preliminary print. In the prior month, the index had registered a reading of -1.3. Moreover, the region’s business climate indicator dropped more-than-expected to a level of 1.05 in July, compared to a revised reading of 1.16 in the prior month.

On the other hand, the region’s economic sentiment indicator surprisingly climbed to a level of 111.2 in July, hitting its highest level in 10 years and defying market consensus for a fall to a level of 110.8. In the previous month, the index had recorded a reading of 111.1.

The greenback lost ground against a basket of major currencies on Friday, after a report showed that the US economy grew less-than-expected in the second quarter.

The US flash annualised gross domestic product (GDP) expanded 2.6% in the second quarter of 2017, propelled by a pick-up in consumer spending, suggesting that the world’s largest economy is gathering momentum. However, the reading fell slightly short of market expectations for an advance of 2.7%, compared to a revised rise of 1.2% registered in the previous quarter. Moreover, the nation’s final Reuters/Michigan consumer sentiment index fell less than initially estimated to a level of 93.4 in July, compared to a reading of 95.1 in the previous month. The preliminary figures had recorded a drop to a level of 93.1.

In the Asian session, at GMT0300, the pair is trading at 1.1735, with the EUR trading 0.19% lower against the USD from Friday’s close.

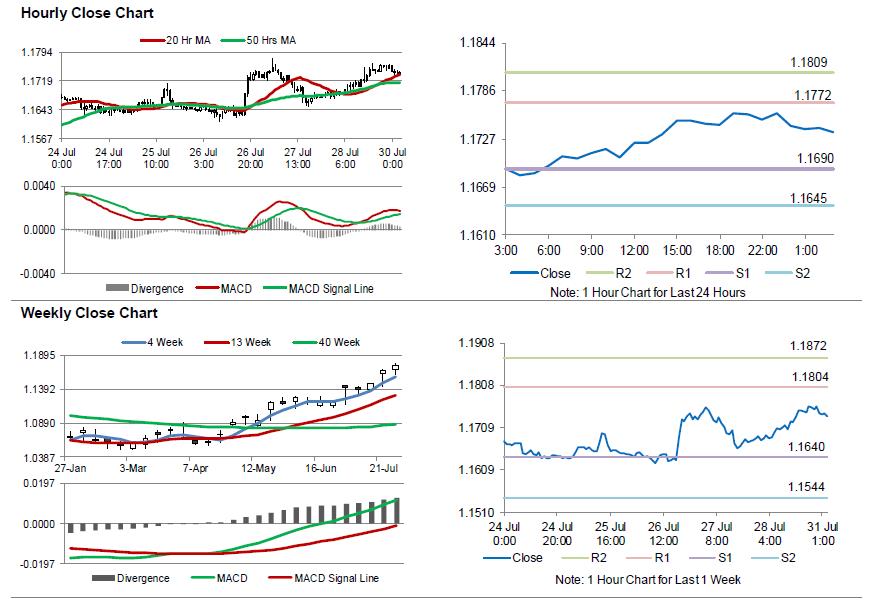

The pair is expected to find support at 1.1690, and a fall through could take it to the next support level of 1.1645. The pair is expected to find its first resistance at 1.1772, and a rise through could take it to the next resistance level of 1.1809.

Moving ahead, investors will keep a close watch on the Euro-zone’s inflation figures for July coupled with the region’s jobs report and Germany’s retail sales data, both for June, all slated to release in a few hours. Additionally, the US pending home sales data for June, due to release later in the day, will keep traders on their toes.

The currency pair is showing convergence with its 20 Hr moving average and trading above its 50 Hr moving average.