For the 24 hours to 23:00 GMT, the EUR declined 0.66% against the USD and closed at 1.1896.

Macroeconomic data indicated that the Euro-zone’s economic confidence index unexpectedly advanced to a level of 111.9 in August, hitting its highest level since July 2007, propelled by higher optimism among industrial and the services sector. Market participants had expected the index to remain unchanged at a revised level of 111.3. Further, the region’s final consumer confidence index improved to a level of -1.5 in August, in line with the flash estimate. The index had recorded a level of -1.7 in the prior month.

Separately, Germany’s flash consumer price index (CPI) climbed 1.8% on an annual basis in August, meeting market expectations and compared to a rise of 1.7% in the prior month.

Meanwhile, rating agency, Moody’s upgraded Euro-zone’s growth forecast for 2017, citing robust momentum across the Euro-bloc. The agency now expects economic growth across the common currency region to hit 2.1% this year, revised up from its earlier forecast of 1.7%.

The greenback gained ground against its key counterparts, following the release of a pair of upbeat economic data.

The second estimate of annualised gross domestic product (GDP) in the US was revised sharply higher to 3.0% in the second quarter of 2017, expanding at its fastest pace in more than two years. The preliminary figures had indicated an advance of 2.6%, while market participants had envisaged for an expansion of 2.7%. In the previous quarter, GDP had posted a revised rise of 1.2%.

Other data showed that ADP’s private sector employment in the US increased more-than-expected by 237.0K in August, rising at its fastest pace in five months and boosting optimism over the state of the nation’s labour market. ADP’s private sector employment rose by a revised 201.0K in the prior month, while markets had anticipated for a rise of 185.0K. On the contrary, the nation’s MBA mortgage applications fell 2.3% in the week ended 25 August 2017, after recording a drop of 0.5% in the prior week.

Meanwhile, Moody’s slashed US growth forecasts for this year and next, stating that the economy disappointed with a weaker performance in the first half of this year. The agency trimmed 2017 growth forecast from 2.4% to 2.2% and cut forecast for 2018 to 2.3% from 2.5% predicted earlier.

In the Asian session, at GMT0300, the pair is trading at 1.1878, with the EUR trading 0.15% lower against the USD from yesterday’s close.

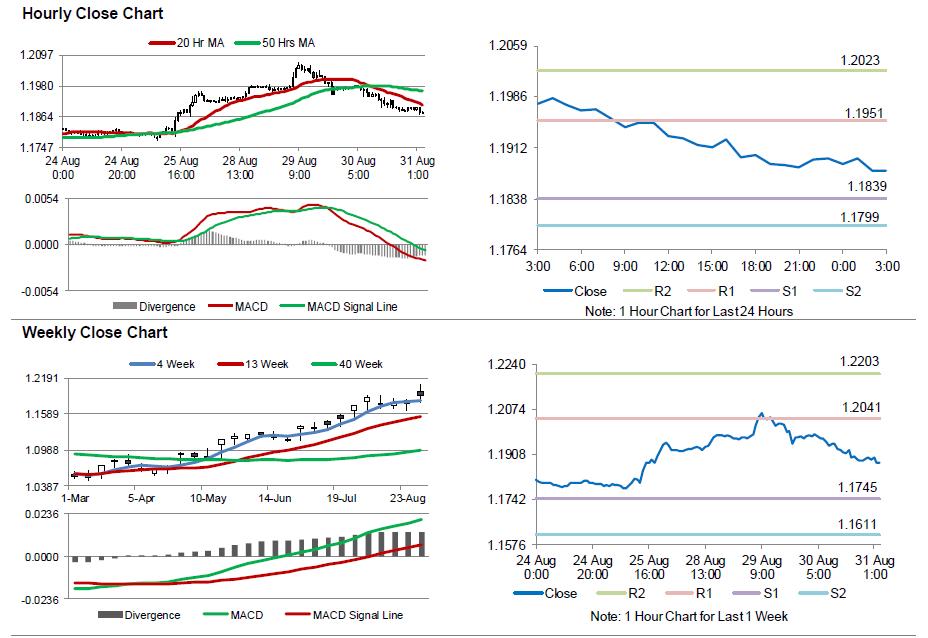

The pair is expected to find support at 1.1839, and a fall through could take it to the next support level of 1.1799. The pair is expected to find its first resistance at 1.1951, and a rise through could take it to the next resistance level of 1.2023.

Trading trend in the Euro today is expected to be determined by the release of the Euro-zone’s flash consumer price inflation for August as well as Germany’s retail sales for July and unemployment rate for August, all scheduled to release in a few hours. Additionally, the US pending home sales, personal income as well as spending data, all for July coupled with the nation’s initial jobless claims data, all set to release later in the day, will pique significant amount of investor attention.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.