For the 24 hours to 23:00 GMT, the EUR declined 0.26% against the USD and closed at 1.1763.

On the macro front, Germany’s seasonally adjusted trade surplus widened to a ten-month high level of €21.2 billion in June, as a fall in imports outstripped that of exports. The nation registered a trade surplus of €20.3 billion in the prior month, while investors had anticipated it to widen to €21.0 billion.

On the other hand, the nation’s seasonally adjusted exports recorded an unexpected drop of 2.8% MoM in June, rising at its weakest pace in nearly two years. Market participants had expected exports to rise 0.2%, after recording a revised advance of 1.5% in the prior month. Also, the nation’s seasonally adjusted imports surprisingly dropped 4.5% on a monthly basis in June, posting its sharpest decline since January 2009. In the prior month, imports had recorded a revised rise of 1.3%, while markets were anticipating for a gain of 0.2%.

The greenback lost ground against most of its key peers, after the US President, Donald Trump warned North Korea that any threats to the US will be “met with fire and fury.”

Earlier in the session, the US Dollar strengthened, following robust US labour market report.

Data showed that JOLTs job openings in US surged to a record high level of 6163.0K in June, topping market consensus for a rise to a level of 5750.0K. In the prior month, JOLTs job openings had recorded a revised reading of 5702.0K. Moreover, the nation’s NFIB small business optimism index unexpectedly climbed to a level of 105.2 in July, notching a five-month high, thus indicating that small business firms are feeling optimistic about the economy’s growth prospects. The index had registered a reading of 103.6 in the previous month, while markets anticipated it to ease to a level of 103.5.

In the Asian session, at GMT0300, the pair is trading at 1.1734, with the EUR trading 0.25% lower against the USD from yesterday’s close.

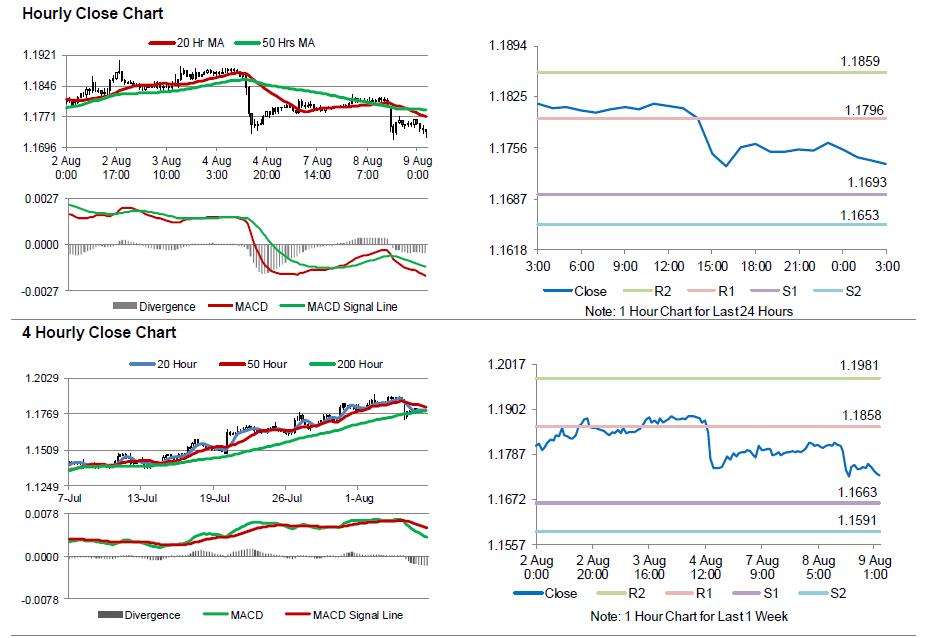

The pair is expected to find support at 1.1693, and a fall through could take it to the next support level of 1.1653. The pair is expected to find its first resistance at 1.1796, and a rise through could take it to the next resistance level of 1.1859.

With no major macroeconomic releases in the Euro-zone today, investors will look forward to the US MBA mortgage applications data, slated to release in a few hours.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.