For the 24 hours to 23:00 GMT, the EUR rose 0.64% against the USD and closed at 1.1426.

On the macro front, Germany’s producer price index climbed 2.6% on an annual basis in February, undershooting market expectations for an advance of 2.9%. The index had registered a similar rise in the previous month.

The US dollar declined against a basket of currencies yesterday, after the US Federal Reserve (Fed) decided to pause its interest rate hikes for 2019 in order to normalize its monetary policy.

The Federal Reserve, in its March interest rate meeting, decided to leave its key interest rate steady at 2.5%, as widely expected, amid signs of a slowdown down in the nation’s growth momentum. The central bank signalled that interest rates are likely to remain unchanged for the remainder of the year and it is in no rush for an interest rate hike before 2020. On the outlook front, the central bank downwardly revised its forecasts for overall consumer price inflation, although core inflation is expected to remain at 2.0% over the next three years. Meanwhile, the Fed also confirmed that it intends to conclude the gradual reduction of its balance sheet by the end of September.

In the US, data showed that the MBA mortgage applications advanced 1.6% on a weekly basis in the week ended 15 March 2019, following a rise of 2.3% in the preceding month.

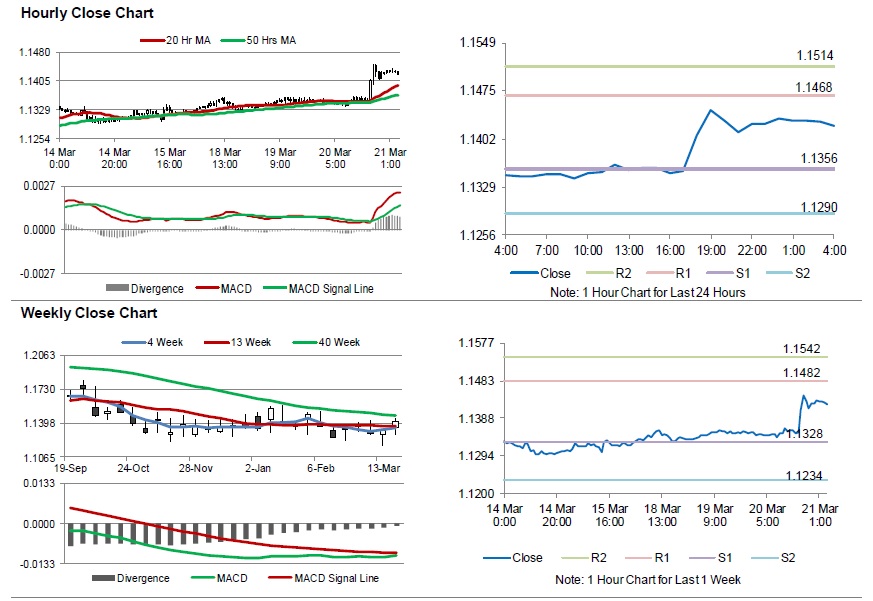

In the Asian session, at GMT0400, the pair is trading at 1.1422, with the EUR trading a tad lower against the USD from yesterday’s close.

The pair is expected to find support at 1.1356, and a fall through could take it to the next support level of 1.1290. The pair is expected to find its first resistance at 1.1468, and a rise through could take it to the next resistance level of 1.1514.

Looking ahead, traders would closely monitor the Euro-zone’s consumer confidence for March, set to release later in the day. Later in the day, the US Philadelphia Fed business outlook for March and the leading index for February along with initial jobless claims, will garner significant amount of investors’ attention.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.