For the 24 hours to 23:00 GMT, the EUR declined 0.37% against the USD and closed at 1.2013, shrugging off upbeat German jobs report.

Data revealed that Germany’s seasonally adjusted unemployment rate remained steady at a record low 5.5% in December, in line with market expectations, as the number of people unemployed sharply fell, thus pointing to a vibrant labour market in the wake of robust growth in the Euro-zone’s largest economy.

The US Dollar gained ground against its key counterparts, after minutes of the Federal Reserve’s (Fed) December monetary policy meeting indicated that officials are mulling a faster pace of rate increases this year.

As per the minutes, policymakers were optimistic that robust economic fundamental in the US economy would warrant a gradual pace for interest rate hikes in 2018. Further, most policymakers shared the view that the latest tax overhaul would likely benefit the economy, but remained split on whether the resulting growth would warrant a faster pace of rate hikes this year, as most believed it to provide a lift to consumer spending and business investment. However, it also revealed disagreement over the pace of rate hikes if inflation struggles to move up towards the central bank’s 2.0% target.

Gains in the greenback were boosted further, on the back of encouraging economic reports in the US.

The US ISM manufacturing activity index unexpectedly climbed to a three-month high level of 59.7 in December, defying market expectations for the index to remain steady at 58.2, thus justifying the notion of strong economic momentum in the world’s largest economy. Moreover, the nation’s construction spending grew 0.8% on a monthly basis in November, advancing for the fourth consecutive month and exceeding market consensus for a gain of 0.5%. Construction spending had risen by a revised 0.9% in the prior month.

Other data showed that the nation’s MBA mortgage applications rebounded 0.7% in the week ended 29 December 2017, after declining 4.9% in the prior week.

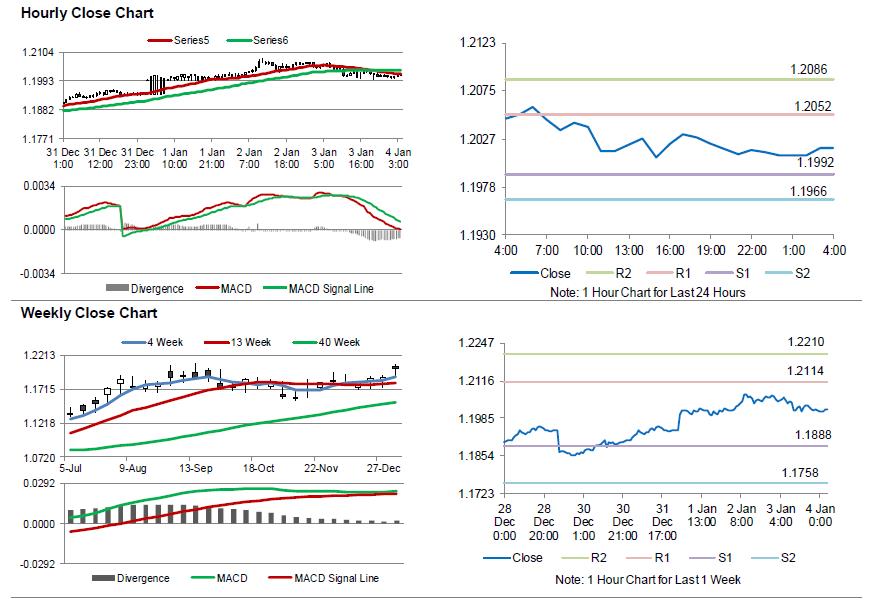

In the Asian session, at GMT0400, the pair is trading at 1.2017, with the EUR trading a tad higher against the USD from yesterday’s close.

The pair is expected to find support at 1.1992, and a fall through could take it to the next support level of 1.1966. The pair is expected to find its first resistance at 1.2052, and a rise through could take it to the next resistance level of 1.2086.

Moving ahead, traders would look forward to the final Markit services PMI for December, scheduled to release across the Euro-zone in a few hours. Moreover, the US ADP employment change and the final Markit services PMI, both for December along with the weekly jobless claims data, all due to release later today, will keep investors on their toes.

The currency pair is showing convergence with its 20 Hr moving average and trading below its 50 Hr moving average.