For the 24 hours to 23:00 GMT, the EUR rose 0.15% against the USD and closed at 1.1714.

In economic news, the Euro-zone’s final Markit services PMI dropped more than initially estimated to a level of 53.8 in May, while the preliminary print had indicated a fall to a level of 53.9. In the prior month, the PMI had registered a reading of 54.7. On the contrary, the region’s seasonally adjusted retail sales rose 0.1% on a monthly basis in April, compared to a revised gain of 0.4% in the previous month. Markets were anticipating retail sales to rise by 0.5%.

Meanwhile, in Germany, the final services PMI fell to a level of 52.1 in May, meeting market expectations. The PMI had registered a level of 53.0 in the prior month. The preliminary figures had also recorded a drop to a level of 52.1.

In the US, data indicated that the nation’s ISM non-manufacturing PMI climbed to a level of 58.6 in May, beating market expectations for a rise to a level of 57.6. In the prior month, the PMI had registered a level of 56.8. Meanwhile, the nation’s final Markit services PMI was revised higher to a level of 56.8 in May, notching its highest level in more than three years. The preliminary figures had indicated a rise to a level of 55.7. In the previous month, the PMI had recorded a reading of 54.6.

In the Asian session, at GMT0300, the pair is trading at 1.1722, with the EUR trading 0.07% higher against the USD from yesterday’s close.

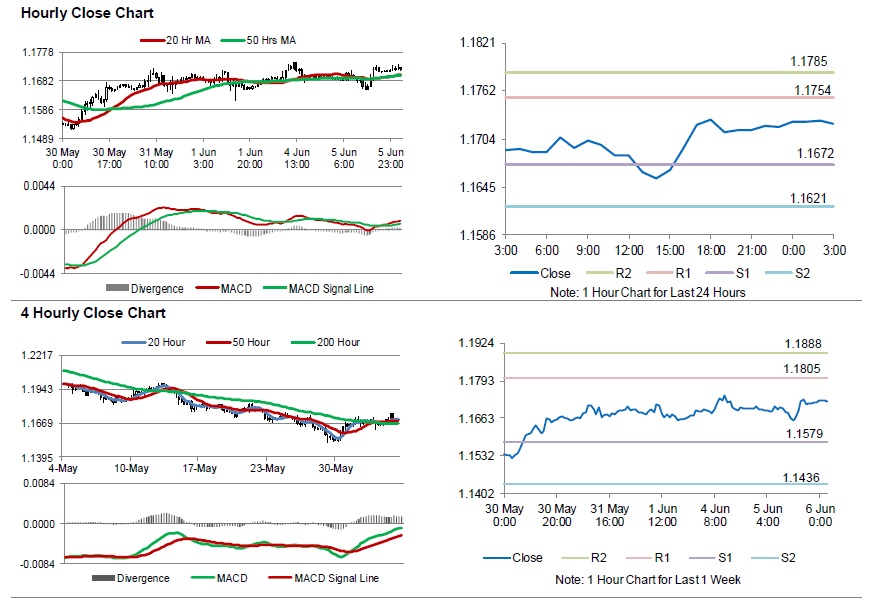

The pair is expected to find support at 1.1672, and a fall through could take it to the next support level of 1.1621. The pair is expected to find its first resistance at 1.1754, and a rise through could take it to the next resistance level of 1.1785.

Amid no major macroeconomic releases in the Euro-zone today, investors would focus on the US trade balance figures for April, set to release later in the day.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.