For the 24 hours to 23:00 GMT, the EUR declined 0.26% against the USD and closed at 1.1640, after data indicated that manufacturing sector growth across the Euro-zone moderated at the start of the third quarter.

The Euro-zone’s preliminary Markit manufacturing PMI dropped more-than-expected to a level of 56.8 in July, hitting its lowest level in three months and compared to a reading of 57.4 in the prior month. Markets were anticipating the PMI to fall to a level of 57.2. Meanwhile, the region’s flash Markit services PMI remained steady at a level of 55.4 in July, in line with market expectations.

Separately, Germany’s manufacturing sector expanded at its weakest pace in three months in July, after it dropped more-than-anticipated to a level of 58.3, compared to a reading of 59.6 registered in the prior month, while investors had envisaged the PMI to drop to a level of 59.2. Moreover, activity in the nation’s services sector unexpectedly slowed to a six-month low level of 53.5 in July, defying market consensus for an advance to a level of 54.3. In the prior month, the PMI had registered a reading of 54.0.

Separately, the International Monetary Fund (IMF), in an updated World Economic Outlook, upgraded the Euro-zone’s economic growth projection for 2017 to 1.9%, up from 1.7% estimated earlier in April, citing solid growth momentum in the single currency region. Meanwhile, the Fund kept its growth forecasts for the world economy unchanged for this year and next.

In the US, data revealed that the flash Markit manufacturing PMI advanced to a four-month high level of 53.2 in July, surpassing market expectations for a rise to a level of 52.3 and compared to a reading of 52.0 in the prior month. Further, the nation’s preliminary Markit services PMI remained steady at a level of 54.2 in July, meeting market expectations.

On the other hand, existing home sales in the US unexpectedly eased 1.8% on a monthly basis, to a level of 5.52 million in June, declining to its lowest level since February 2017. Existing home sales registered a reading of 5.62 million in the prior month, while markets were expecting it to remain unchanged at 5.57 million.

Meanwhile, the IMF revised down US economic growth forecast to 2.1% for this year and next, citing the US President, Donald Trump’s struggle to deliver on policy and stimulus.

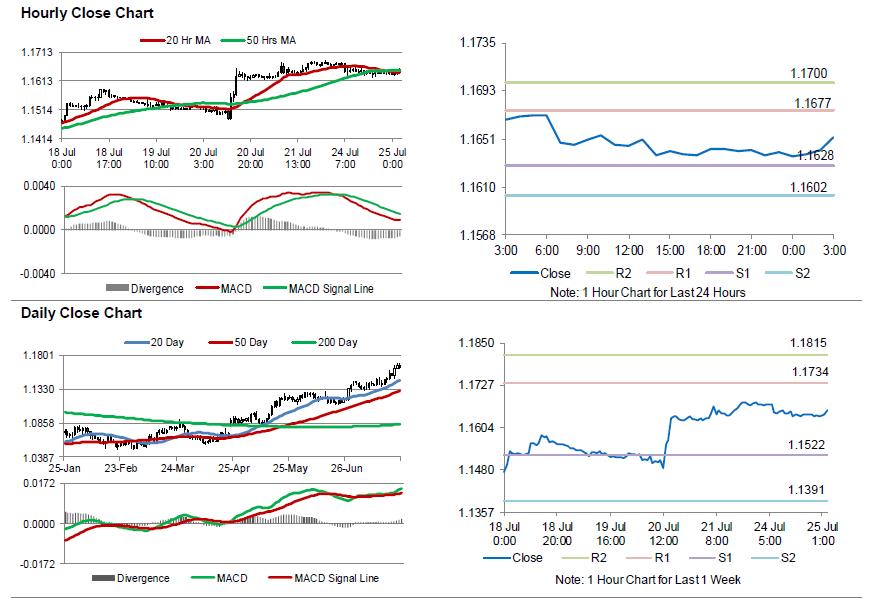

In the Asian session, at GMT0300, the pair is trading at 1.1653, with the EUR trading 0.11% higher against the USD from yesterday’s close.

The pair is expected to find support at 1.1628, and a fall through could take it to the next support level of 1.1602. The pair is expected to find its first resistance at 1.1677, and a rise through could take it to the next resistance level of 1.1700.

Moving ahead, investors will focus on Germany’s Ifo business climate and expectations indices for July, slated to release in a few hours. Moreover, the US consumer confidence index for July, due to release later in the day, will pique significant amount of investor attention.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.