For the 24 hours to 23:00 GMT, the EUR rose 0.68% against the USD and closed at 1.2033, after the European Central Bank (ECB) unveiled upbeat minutes from its December policy meeting.

Minutes showed that the Governing Council could consider revising the outlook for the central bank’s massive monetary stimulus program early this year, as there was a “widely shared” view that the common currency region’s robust economic recovery had now moved into expansionary territory.

On the macro front, the Euro-zone’s seasonally adjusted industrial production advanced 1.0% on a monthly basis in November, surpassing market expectations for a gain of 0.8%. Industrial production had risen by a revised 0.4% in the prior month.

The greenback declined against its key peers, after producer prices in the US unexpectedly dropped 0.1% on a monthly basis in December, declining for the first time in over a year, thus intensifying concerns that factors restraining inflation could become more persistent. Producer prices had advanced 0.4% in the prior month, while investors had envisaged for a rise of 0.2%. Moreover, the number of Americans filing for fresh jobless claims registered an unexpected rise to a level of 261.0K in the week ended 06 January, hitting a nearly 4-month high level. Initial jobless claims had registered a reading of 250.0K in the previous week, while market participants had expected for a drop to a level of 245.0K.

Other data showed that budget deficit in the US narrowed more-than-expected to $23.2 billion in December, following a deficit of $138.5 billion in the prior month. Markets were anticipating the nation to record a budget deficit of $26.0 billion.

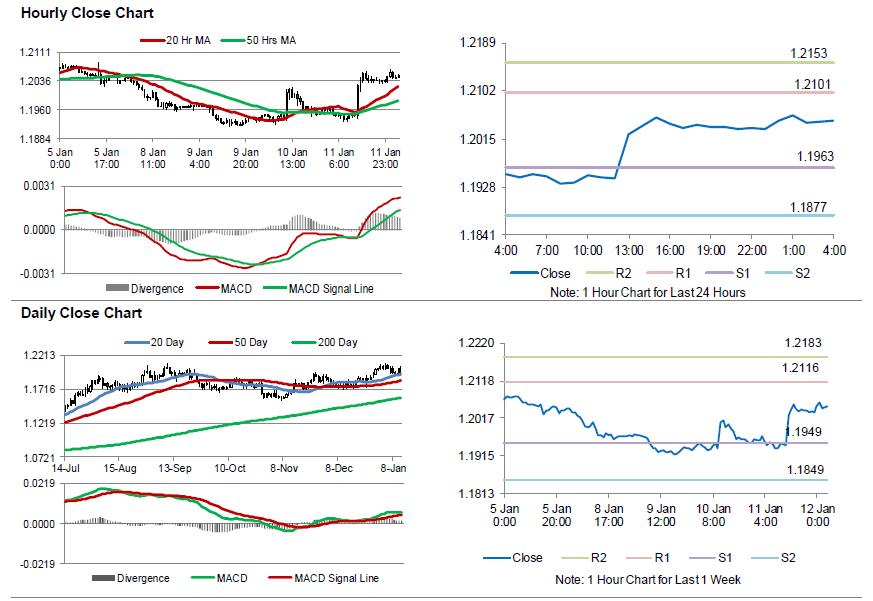

In the Asian session, at GMT0400, the pair is trading at 1.2049, with the EUR trading 0.13% higher against the USD from yesterday’s close.

The pair is expected to find support at 1.1963, and a fall through could take it to the next support level of 1.1877. The pair is expected to find its first resistance at 1.2101, and a rise through could take it to the next resistance level of 1.2153.

Amid no key macroeconomic releases in the Euro-zone today, investors would look forward to the release of final inflation numbers across the Euro-zone, scheduled to release next week. Later today, all eyes will be on the release of crucial US consumer price inflation and retail sales data, both for December.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.