For the 24 hours to 23:00 GMT, the EUR declined 0.26% against the USD and closed at 1.0748, after the European Central Bank (ECB) President, Mario Draghi brushed off calls for the ECB to reduce stimulus.

The ECB President, in a speech before the European Parliament in Brussels, stated that despite signs of improvement in headline inflation, the Euro-zone’s economy as well as underlying inflation wasn’t yet strong enough to withdraw stimulus. He further stated that the pick-up in inflation was driven mainly by higher energy prices rather than fundamental price pressures from rising wages. Draghi also denied allegations of currency manipulation.

On the macro front, the Euro-zone’s Sentix investor confidence index fell less-than-expected to a level of 17.4 in February. Meanwhile, market participants expected the index to drop to a level of 16.8, following a reading of 18.2 in the prior month.

Separately, Germany’s seasonally adjusted factory orders rebounded 5.2% MoM in December, rising at its fastest pace since July 2014, thus boosting optimism over the health of the nation’s economy. Factory orders had registered a revised drop of 3.6% in the previous month, while markets anticipated for a rise of 0.7%. Meanwhile, the nation’s Markit construction PMI edged down to a level of 52.0 in January, hitting its lowest level since August 2016 and compared to a level of 54.9 in the preceding month.

Macroeconomic data indicated that the US labour market conditions index increased to a level of 1.3 in January, following a revised rise of 0.6 in the previous month.

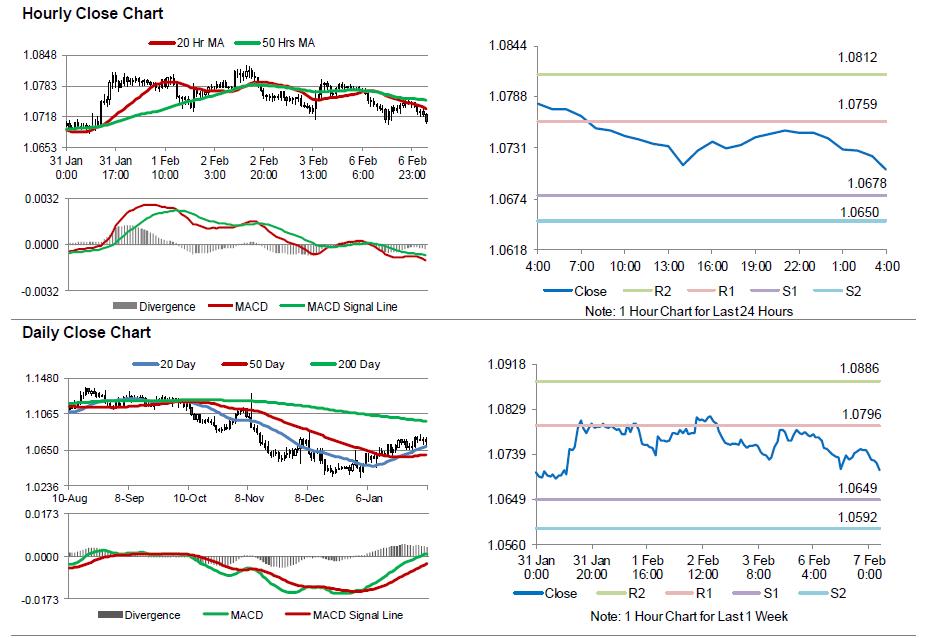

In the Asian session, at GMT0400, the pair is trading at 1.0707, with the EUR trading 0.38% lower against the USD from yesterday’s close.

The pair is expected to find support at 1.0678, and a fall through could take it to the next support level of 1.065. The pair is expected to find its first resistance at 1.0759, and a rise through could take it to the next resistance level of 1.0812.

Trading trends in the Euro today is expected to be determined by the release of Germany’s industrial production data for December, slated to release in a few hours. Additionally, investors will look forward to the US trade balance, consumer credit change and JOLTS job openings, all for December, scheduled to release later today.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.