For the 24 hours to 23:00 GMT, the EUR declined 1.01% against the USD and closed at 1.1195, after the European Central Bank (ECB) decided not to raise interest rates until 2020 and slashed its growth forecast for the euro area.

On the data front, Euro-zone’s seasonally adjusted second estimate of gross domestic product (GDP) rose 0.2% on a quarterly basis in 4Q 2018, at par with market expectations and confirming the preliminary figures. The GDP had registered a similar rise in the prior quarter.

The ECB, in its March monetary policy meeting, decided to keep its benchmark interest rate steady at 0.00%, and stated that there would be no changes to the monetary policy before 2020. Further, the central bank trimmed its economic growth forecast for the euro area to 1.1% from 1.7% for 2019. Also, the ECB announced the launch of a new series of targeted longer-term refinancing operations (TLTRO), in an effort to aid the bank lending conditions.

In the US, data showed that the seasonally adjusted initial jobless claims eased to a level of 223.0K in the week ended 02 March 2019, compared to a revised level of 226.0K in the prior week. Market participants had envisaged the initial jobless claims to fall to a level of 225.0K. Additionally, consumer credit advanced by $17.1 billion in January, more than market expectations. In the previous month, consumer credit had advanced by a revised $15.4 billion.

In the Asian session, at GMT0400, the pair is trading at 1.1196, with the EUR trading a tad higher against the USD from yesterday’s close.

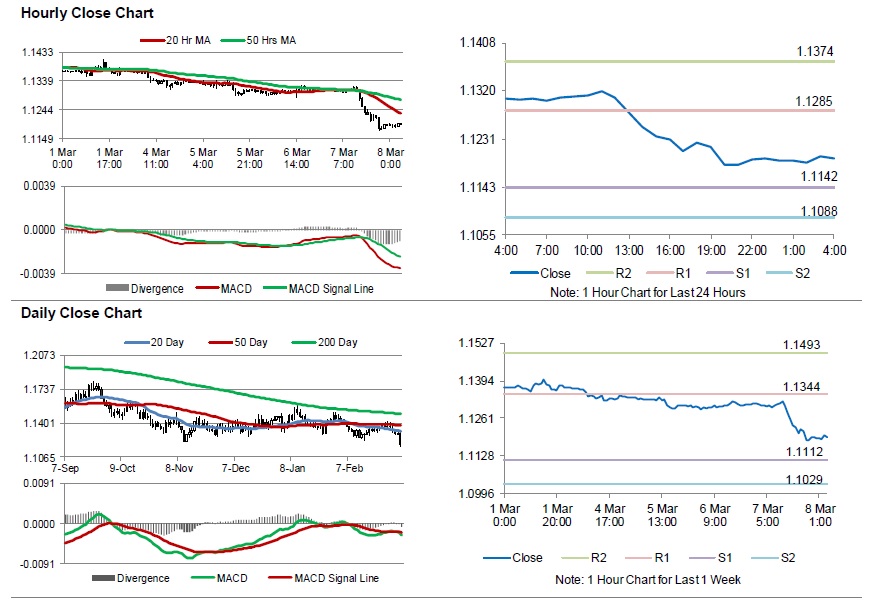

The pair is expected to find support at 1.1142, and a fall through could take it to the next support level of 1.1088. The pair is expected to find its first resistance at 1.1285, and a rise through could take it to the next resistance level of 1.1374.

Going forward, traders would await Germany’s factory orders for January, set to release in a few hours. Later in the day, the US housing starts and building permits for January along with non-farm payrolls, unemployment rate, average hourly earnings, all for February, will keep traders on their toes.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.