For the 24 hours to 23:00 GMT, the GBP rose 0.53% against the USD and closed at 1.2353, after a Bank of England (BoE) policymaker surprised investors by voting to raise interest rates by 25 basis point, while some others indicated that they were also leaning towards raising interest rates in the foreseeable future.

The BoE, in its latest monetary policy meeting, maintained the benchmark interest rate steady at a record low of 0.25% in an 8-1 vote, with Kristin Forbes voting to raise borrowing costs immediately. Further, the central bank decided to leave the bond-purchase programme unchanged at £435.0 billion. The minutes from the meeting suggested that it would not take much for “some” other officials to join her if inflation or economic growth rise significantly. Moreover, policymakers felt there were signs that consumers were turning more cautious as inflation rose while pay growth, which has been slowing in recent months, had turned out to be “notably weaker”.

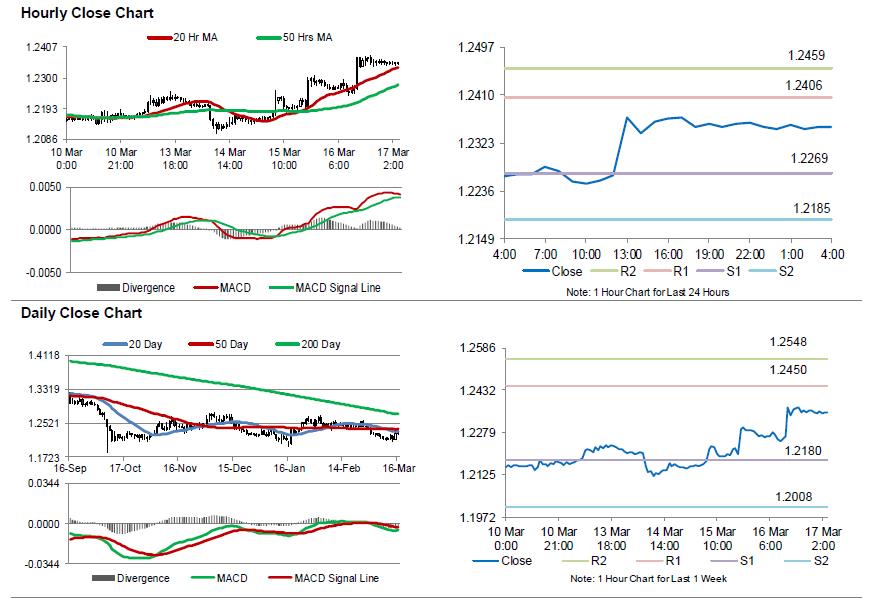

In the Asian session, at GMT0400, the pair is trading at 1.2352, with the GBP trading a tad lower against the USD from yesterday’s close.

The pair is expected to find support at 1.2269, and a fall through could take it to the next support level of 1.2185. The pair is expected to find its first resistance at 1.2406, and a rise through could take it to the next resistance level of 1.2459.

Moving ahead, traders will look forward to the BoE’s quarterly bulletin report, set to release in a few hours.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.