For the 24 hours to 23:00 GMT, the GBP declined 0.61% against the USD and closed at 1.3118, amid growing fears that a no-deal Brexit would become a reality.

On the macro front, UK’s public sector net borrowing surplus narrowed to a 17-year low level of £0.7 billion in February, compared to a revised surplus of £14.1 billion in the prior month. Markets had anticipated the public sector net borrowing to post a surplus of £0.8 billion. Meanwhile, Britain’s retail sales climbed 4.0% on a yearly basis in February, beating market expectations for a rise of 3.3%. In the previous month, retail sales had registered a revised gain of 4.1%.

The Bank of England, in its latest monetary policy meeting, kept its key interest rate unchanged at 0.75%, as widely expected. Additionally, the central bank reiterated that a further tightening of policy at a gradual pace may be required, if the economy expands in line with projections. Meanwhile, the central bank forecasted a 0.3% GDP growth for the first quarter.

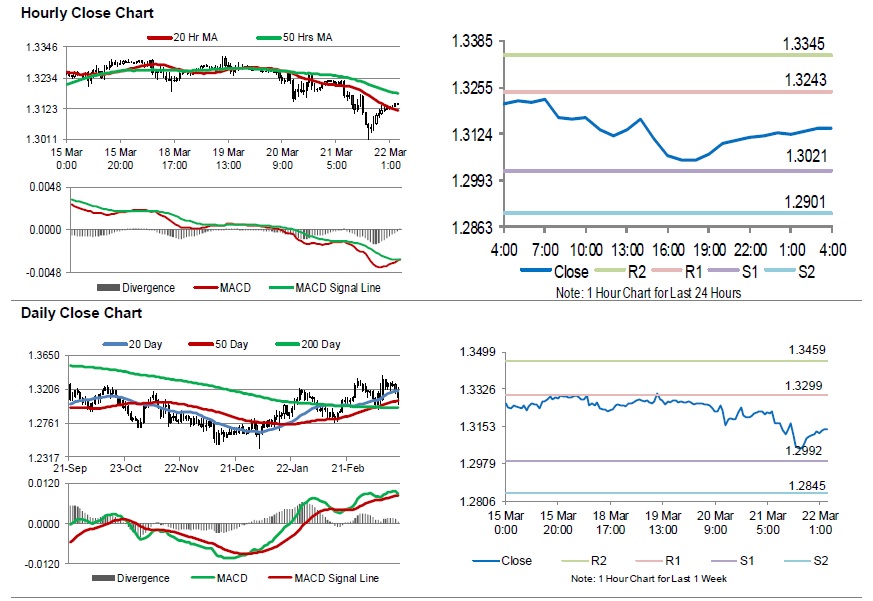

In the Asian session, at GMT0400, the pair is trading at 1.3140, with the GBP trading 0.17% higher against the USD from yesterday’s close.

The pair is expected to find support at 1.3021, and a fall through could take it to the next support level of 1.2901. The pair is expected to find its first resistance at 1.3243, and a rise through could take it to the next resistance level of 1.3345.

Amid no major economic releases in UK today, investors would focus on global macroeconomic events for further direction.

The currency pair is trading between its 20 Hr and 50 Hr moving averages.