For the 24 hours to 23:00 GMT, the GBP declined 0.6% against the USD and closed at 1.3142, after the Bank of England (BoE) downgraded UK’s economic growth forecast.

The BoE monetary policy committee voted 6-2 to keep its key interest rate unchanged at 0.25% and left unchanged the size of its asset purchase programme at £435.0 billion.

The central bank, its quarterly inflation report, slashed UK’s economic growth forecast to 1.7% in 2017 and 1.6% in 2018, from 1.9% and 1.7% respectively, arguing that economic growth remains sluggish in the near-term as the economy has started to feel the negative effects emerging out of uncertainties of Brexit. Meanwhile, inflation is expected to peak at around 3.0% by October 2017, before gradually moderating, and falling to 2.2% by 2020.

Prior to the monetary policy decision, Pound was boosted by robust UK Markit services PMI data that showed the nation’s services sector expanded faster-than-anticipated to a level of 53.8 in July, compared to market consensus for a rise to a level of 53.6. The PMI had recorded a reading of 53.4 in the prior month.

In the Asian session, at GMT0300, the pair is trading at 1.3137, with the GBP trading a tad lower against the USD from yesterday’s close.

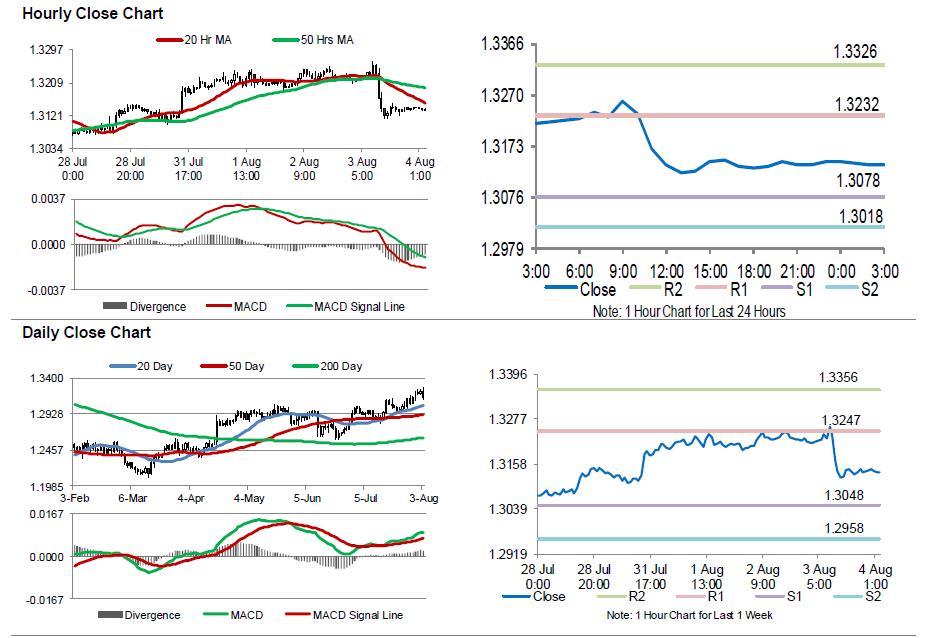

The pair is expected to find support at 1.3078, and a fall through could take it to the next support level of 1.3018. The pair is expected to find its first resistance at 1.3232, and a rise through could take it to the next resistance level of 1.3326.

Amid no major economic releases in UK today, investors will look forward to Britain’s trade balance, manufacturing as well as industrial production data, all due to release next week.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.