For the 24 hours to 23:00 GMT, the GBP declined 0.6% against the USD and closed at 1.3515,

after the Bank of England (BoE) Governor, Mark Carney, indicated that any future interest rate hikes would be limited and gradual.

Further, Carney, in a speech at the International Monetary Fund (IMF), warned that economic implications of Brexit has yet to be felt and will likely slowdown the British economic growth until the middle of next year and push inflation up, as it has already prompted households to cut back on spending and businesses to invest less than usual.

In the Asian session, at GMT0300, the pair is trading at 1.3512, with the GBP trading slightly lower against the USD from yesterday’s close.

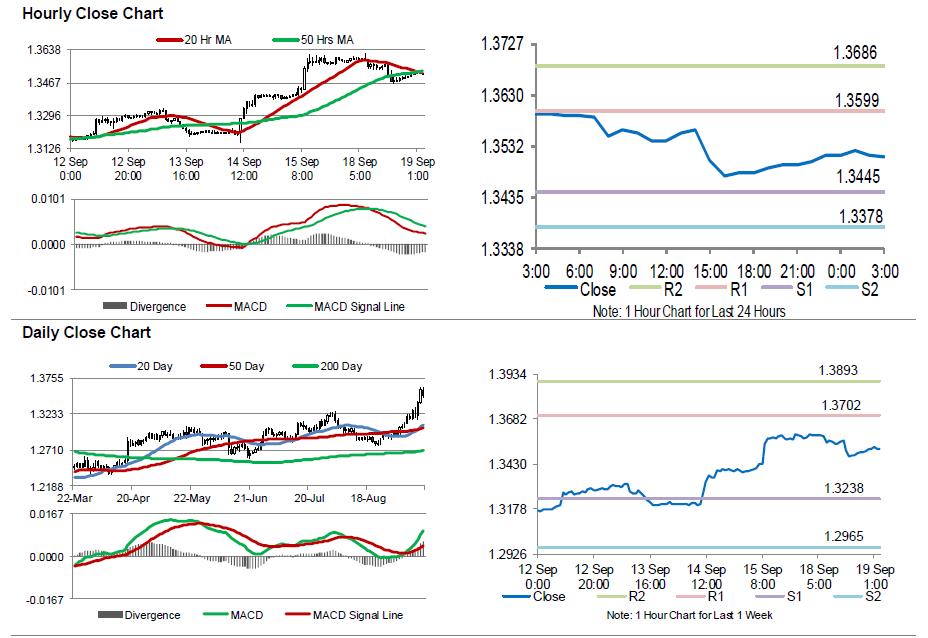

The pair is expected to find support at 1.3445, and a fall through could take it to the next support level of 1.3378. The pair is expected to find its first resistance at 1.3599, and a rise through could take it to the next resistance level of 1.3686.

In absence of any macroeconomic releases in the UK today, investors will look forward to global macroeconomic events for further direction.

The currency pair is showing convergence with its 20 Hr moving average and trading below its 50 Hr moving average.