For the 24 hours to 23:00 GMT, the GBP declined 0.31% against the USD and closed at 1.3379, amid a slew of disappointing economic releases in the UK.

In the economic news, UK’s manufacturing production unexpectedly declined by 1.4% on a monthly basis in April, recording its largest fall since October 2012. Markets had expected manufacturing production to rise 0.3%, after recording a drop of 0.1% in the preceding month. Additionally, the nation’s industrial production retreated by 0.8% on a monthly basis in April, defying market expectations for a rise of 0.1%. Industrial production had climbed 0.1% in the previous month. Moreover, trade deficit widened to £5.2 billion in April, compared to a revised deficit of £3.2 billion in the prior month. Markets had envisaged the trade deficit to narrow to £2.5 billion.

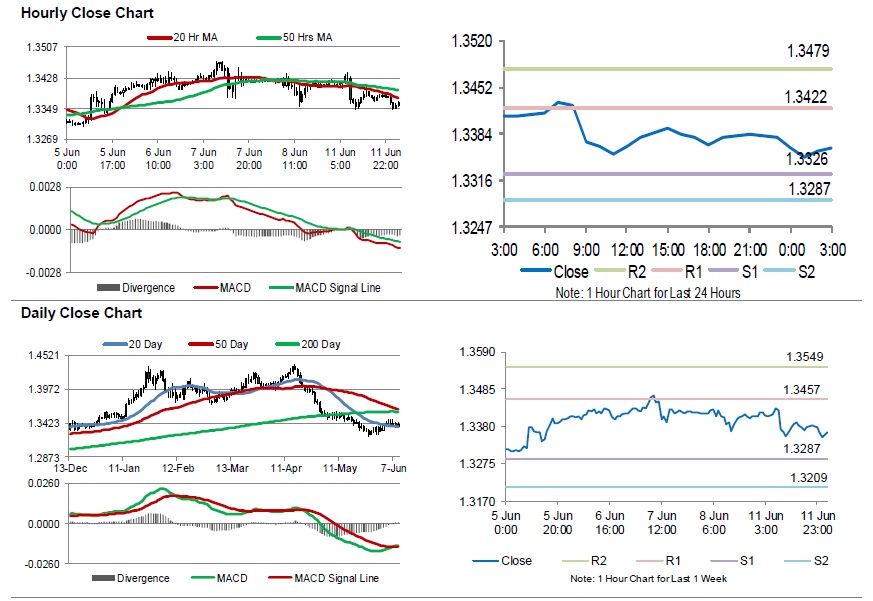

In the Asian session, at GMT0300, the pair is trading at 1.3364, with the GBP trading 0.11% lower against the USD from yesterday’s close.

The pair is expected to find support at 1.3326, and a fall through could take it to the next support level of 1.3287. The pair is expected to find its first resistance at 1.3422, and a rise through could take it to the next resistance level of 1.3479.

Looking ahead, investors would closely monitor UK’s ILO unemployment rate and average weekly earnings, both for April, slated to release in a few hours.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.