For the 24 hours to 23:00 GMT, the GBP rose 0.9% against the USD and closed at 1.3296, surging to a one-year high level, after larger-than-expected rise in UK inflation reinvigorated hopes that the Bank of England (BoE) will raise interest rates sooner than expected.

Data indicated that Britain’s consumer price index (CPI) climbed more-than-expected by 2.9% on a yearly basis in August, matching a five-year high level recorded in May 2017 and exerting fresh pressure on the BoE to make moves with interest rates to try and limit soaring inflation. Markets had expected the CPI to gain 2.8%, after recording a rise of 2.6% in the prior month.

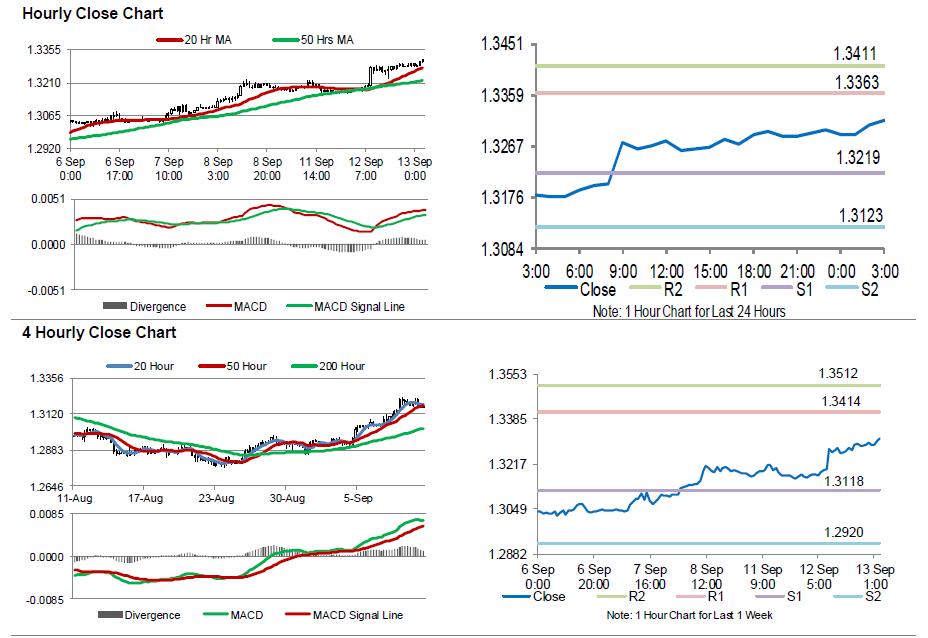

In the Asian session, at GMT0300, the pair is trading at 1.3315, with the GBP trading 0.14% higher against the USD from yesterday’s close.

The pair is expected to find support at 1.3219, and a fall through could take it to the next support level of 1.3123. The pair is expected to find its first resistance at 1.3363, and a rise through could take it to the next resistance level of 1.3411.

Going forward, UK’s ILO unemployment rate data for the three months to July, set to release in a few hours, will pique significant amount of investor attention.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.