For the 24 hours to 23:00 GMT, the GBP declined 4.00% against the USD and closed at 1.2507 on Friday.

On the data front, UK’s Nationwide housing prices rose 3.7% on a yearly basis in April, recording to its fastest pace since 2017 and more than market expectations for a rise of 2.5%. In the previous month, housing prices had recorded an advance of 3.0%. Meanwhile, the Markit manufacturing PMI dropped to 32.6 in April, compared to a reading of 47.8 in the previous month. The preliminary figures had indicated a drop to 32.9. Moreover, mortgage approvals fell to 56.2K in March, marking its lowest level since March 2013 and more than market consensus for a fall to a level of 60.0K. In the previous month, mortgage approvals had recorded a revised reading of 73.7K. Additionally, net consumer credit declined by £3.80 billion in March. In the prior month, net consumer credit had recorded a rise of £0.88 billion.

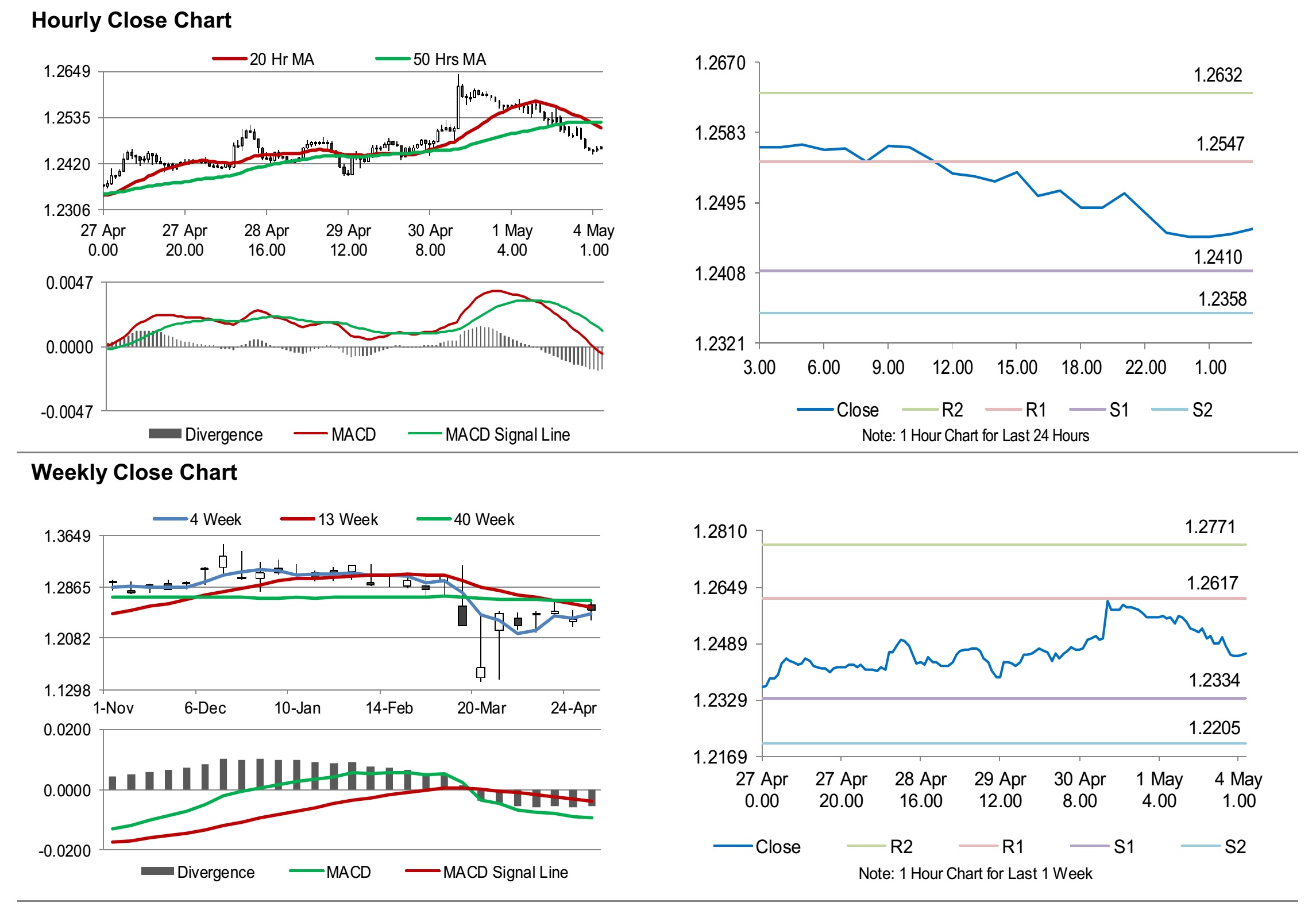

In the Asian session, at GMT0300, the pair is trading at 1.2462, with the GBP trading 0.36% lower against the USD from Friday’s close.

The pair is expected to find support at 1.2410, and a fall through could take it to the next support level of 1.2358. The pair is expected to find its first resistance at 1.2547, and a rise through could take it to the next resistance level of 1.2632.

Amid lack of macroeconomic releases in the UK today, investor sentiment would be determined by global macroeconomic factors.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.