For the 24 hours to 23:00 GMT, the GBP fell 0.07% against the USD and closed at 1.6035, after retail sales in the UK eased 0.3% on a monthly basis in September, higher than market expectations for a flat reading and compared to a rise of 0.3% registered in the prior month, thus dampening optimism over the country’s economic outlook. Additionally, the CBI business optimism in the nation deteriorated to a reading of 8.0 in October, lower than market forecast for a level of 15.0 and after registering a reading of 19.0 in September. Also, the BBA mortgage approvals registered an unexpected drop to 39.27 K, following a revised reading of 41.36 recorded in the previous month. Markets were expecting it to rise to 41.45 K in September.

Separately, the BoE’s Deputy Governor, Ben Broadbent stated that the interest rates in the UK was likely to stay low for an extended period of time and according to him the central bank would raise it gradually. He further indicated that the current low inflation and risk adjusted returns on investments would probably rise as productivity improved.

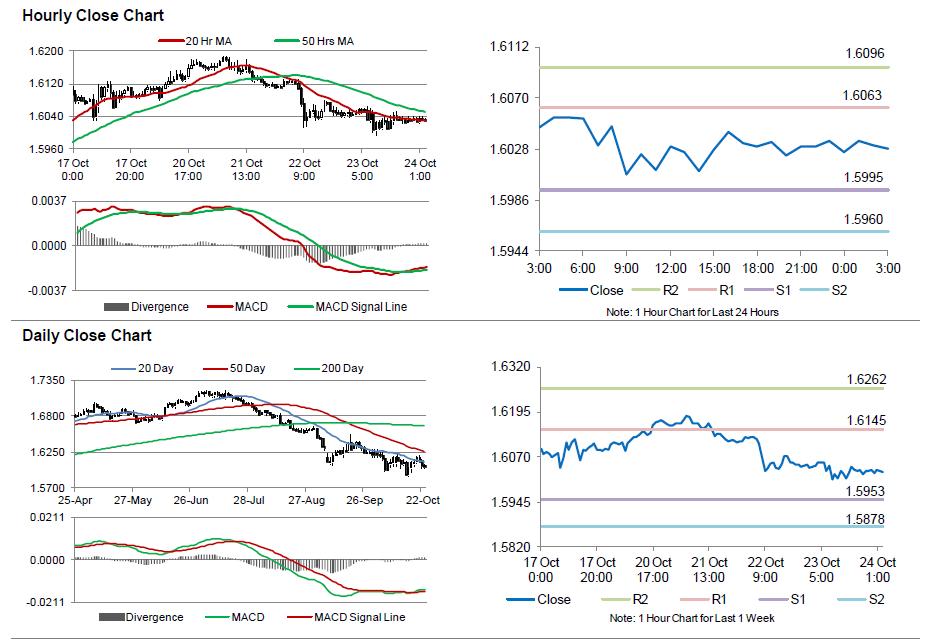

In the Asian session, at GMT0300, the pair is trading at 1.6029, with the GBP trading a tad lower from yesterday’s close.

The pair is expected to find support at 1.5995, and a fall through could take it to the next support level of 1.5960. The pair is expected to find its first resistance at 1.6063, and a rise through could take it to the next resistance level of 1.6096.

Trading trends in the Pound today would be determined by the UK’s crucial GDP data, scheduled in a few hours.

The currency pair is showing convergence with its 20 Hr moving average and trading below its 50 Hr moving average.