For the 24 hours to 23:00 GMT, the GBP rose 0.15% against the USD and closed at 1.2528.

The Bank of England (BoE), in its semi-annual Financial Stability Report (FSR), warned that the increasing likelihood of a no-deal Brexit could cause massive disruption to the UK economy. Additionally, the report highlighted a gloomy outlook for the UK economy, citing no-deal Brexit risks and trade tensions. However, the BoE indicated that UK’s banks, dealers and insurers are prepared for ‘a worst-case disorderly Brexit’.

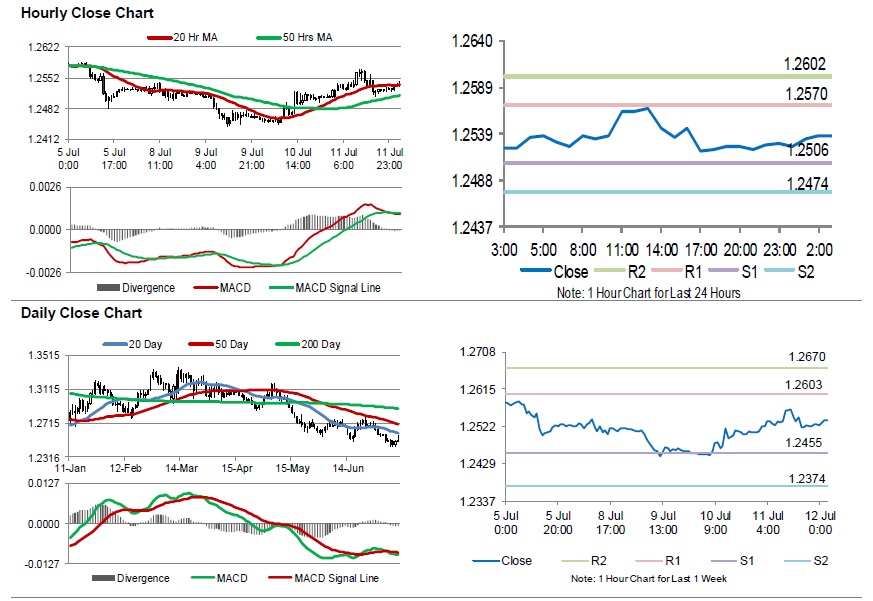

In the Asian session, at GMT0300, the pair is trading at 1.2537, with the GBP trading 0.07% higher against the USD from yesterday’s close.

The pair is expected to find support at 1.2506, and a fall through could take it to the next support level of 1.2474. The pair is expected to find its first resistance at 1.2570, and a rise through could take it to the next resistance level of 1.2602.

Looking forward, traders would keep an eye on the UK’s Rightmove house price index, average weekly earnings and the ILO unemployment rate, all set to release next week.

The currency pair is showing convergence with its 20 Hr moving average and trading above its 50 Hr moving average.