On Friday, the GBP marginally declined against the USD and closed at 1.6980, despite data indicated that the recovery in the British economy is on track.

Official data released indicated that GDP rose 0.8% in Q2, on a quarterly basis in June, in the UK, compared to a similar rise a quarter ago and market expectations. Additionally, the index of services recorded a rise of 0.3% in May, on a monthly basis, beating the market expectations for a 0.2% rise.

Moreover, the IMF admitted that it had predicted wrong about the UK’s recovery earlier this year and placed the nation on top on economic growth compared to any other G7 nation, indicating that the BoE policymakers would be forced to think about the much anticipated interest rate hike by the end of this year.

Simultaneously, the UK Chancellor George Osborne, in an interview to BBC, stated that the recent GDP figures have shown that the British economy is now on track and is above its peak before the global recession began in 2008 and hinted that the economy still has a long way to go, cautioning that the nation should not repeat its earlier mistakes.

In the Asian session, at GMT0300, the pair is trading at 1.6976, with the GBP trading marginally lower from Friday’s close.

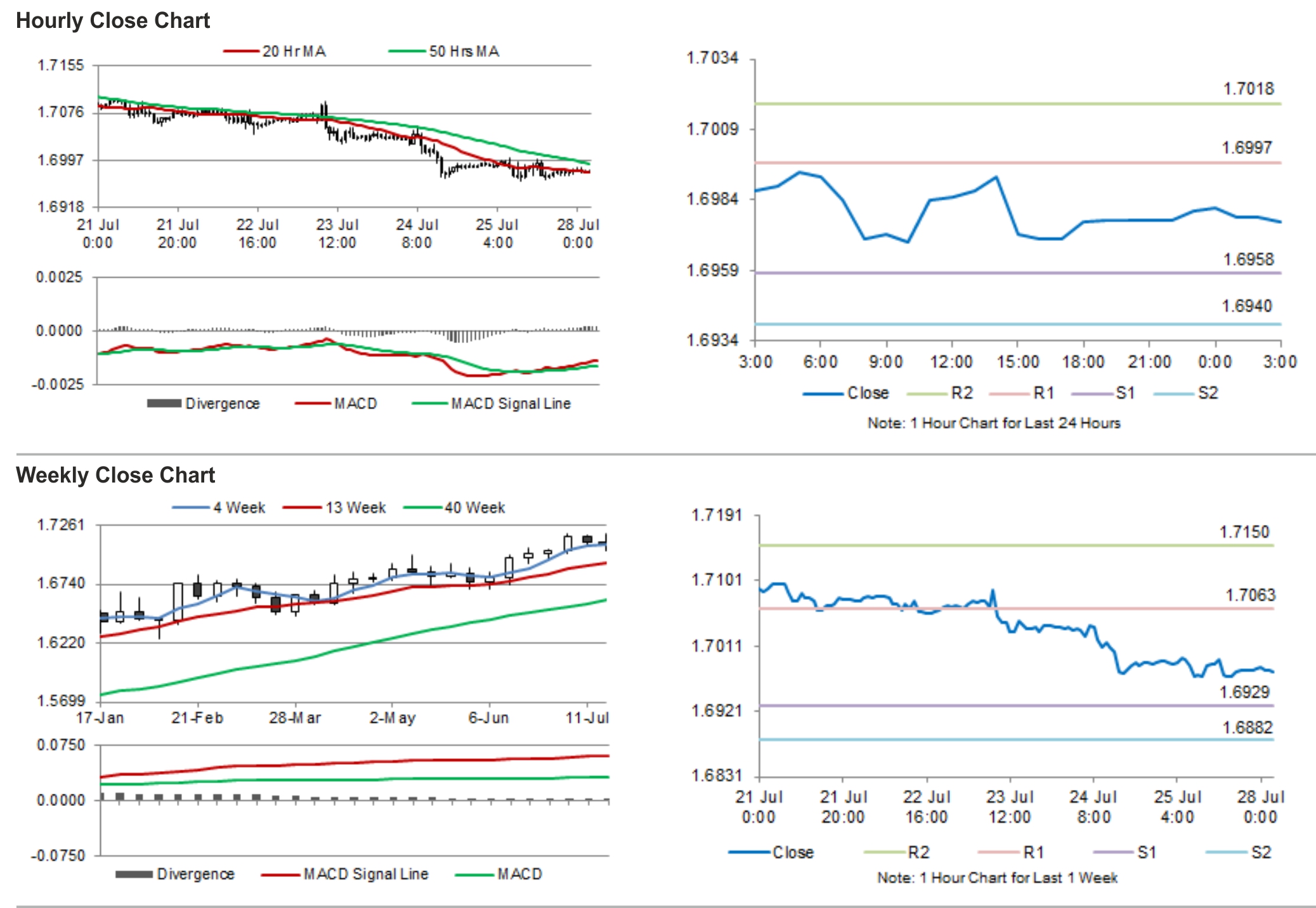

The pair is expected to find support at 1.6958, and a fall through could take it to the next support level of 1.6940. The pair is expected to find its first resistance at 1.6997, and a rise through could take it to the next resistance level of 1.7018.

With no economic releases from the UK scheduled today, investors would look forward to mortgage approvals and net lending to individuals data from the UK, scheduled to be released tomorrow,

The currency pair is showing convergence with its 20 Hr moving average and is trading below its 50 Hr moving average.