For the 24 hours to 23:00 GMT, GBP rose 0.47% against the USD and closed at 1.6803, after data showed that Britain’s unemployment rate unexpectedly dropped to a five-year low level of 6.9% in the three months to February, below the BoE’s 7% threshold which was set as an initial guide for considering a rise in interest rates. Additionally, the number of people claiming jobless benefits in the nation fell by 30,400 to 1.142 million in March, its lowest level since November 2008, further boosting the Sterling.

Other data revealed that the average earnings including bonus in UK rose 1.7% for December 2013 to February 2014, compared to a 1.4% rise for September to November 2013. Meanwhile, average earnings excluding bonus in UK advanced 1.4% in December 2013 to February 2014, following a revised increase of 1.2% recorded for September to November 2013.

In the Asian session, at GMT0300, the pair is trading at 1.6835, with the GBP trading 0.19% higher from yesterday’s close.

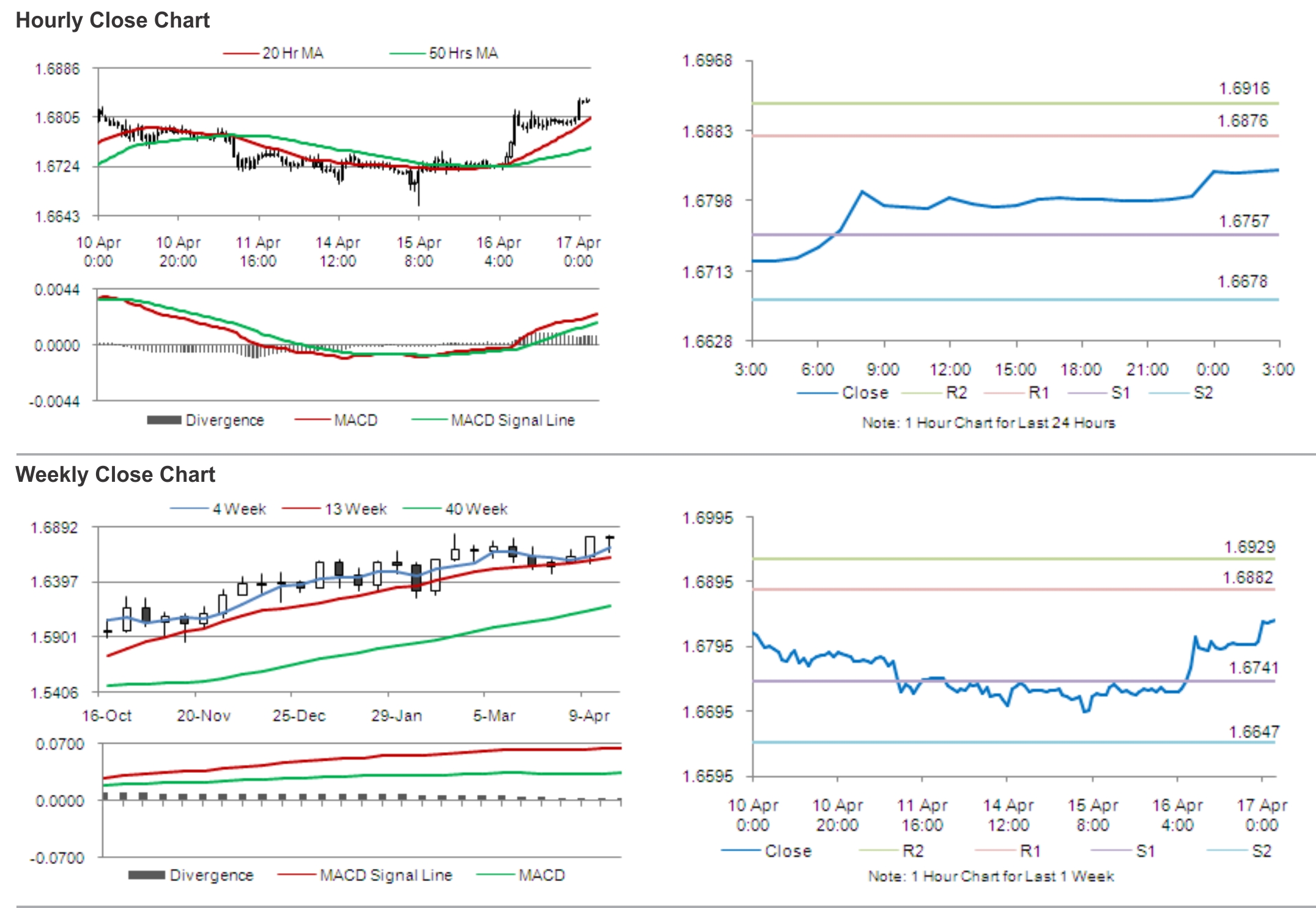

The pair is expected to find support at 1.6757, and a fall through could take it to the next support level of 1.6678. The pair is expected to find its first resistance at 1.6876, and a rise through could take it to the next resistance level of 1.6916.

With no major economic releases from the UK, during the later course of the day, traders would keep a tab on global economic news, especially US weekly jobless claims data, for further guidance in the pair.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.