For the 24 hours to 23:00 GMT, the GBP declined 0.25% against the USD and closed at 1.4002, after softer-than-expected UK inflation figures alleviated the pressure on the Bank of England to raise key interest rates.

Britain’s consumer price index (CPI) advanced less-than-anticipated by 2.7% on a yearly basis in February, rising at its weakest pace since July 2017, thus offering fresh evidence of retreating inflation pressures and suggesting that the impact of the Brexit-hit pound has started to abate.

Market participants had expected the CPI to increase by 2.8%, after recording a gain of 3.0% in the prior month.

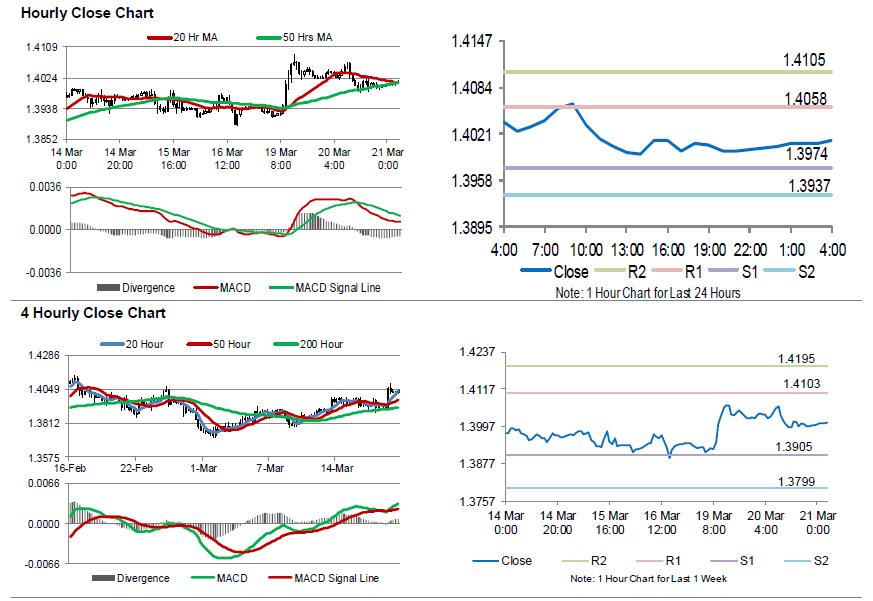

In the Asian session, at GMT0400, the pair is trading at 1.4012, with the GBP trading 0.07% higher against the USD from yesterday’s close.

The pair is expected to find support at 1.3974, and a fall through could take it to the next support level of 1.3937. The pair is expected to find its first resistance at 1.4058, and a rise through could take it to the next resistance level of 1.4105.

Moving ahead, market participants would keep a close watch on UK’s ILO unemployment rate for the three months ended January as well as public sector net borrowing data for February, both slated to release in a few hours.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.