For the 24 hours to 23:00 GMT, the GBP declined 0.17% against the USD and closed at 1.3033, after the Bank of England held its interest rate unchanged.

The Bank of England in its latest monetary policy meeting, unanimously voted to leave its key interest rate steady at 0.75%, as widely expected and expects an additional interest rate hike to balance inflation. Further, the central bank upgraded its GDP forecast to 1.5% from 1.2% in order to strengthen Brexit-related stock building.

In economic news, UK’s construction PMI climbed to a level of 50.5 in April, more than market expectations for a rise to a level of 50.3. The PMI had registered a level of 49.7 in the prior month.

In the Asian session, at GMT0300, the pair is trading at 1.3040, with the GBP trading 0.05% higher against the USD from yesterday’s close.

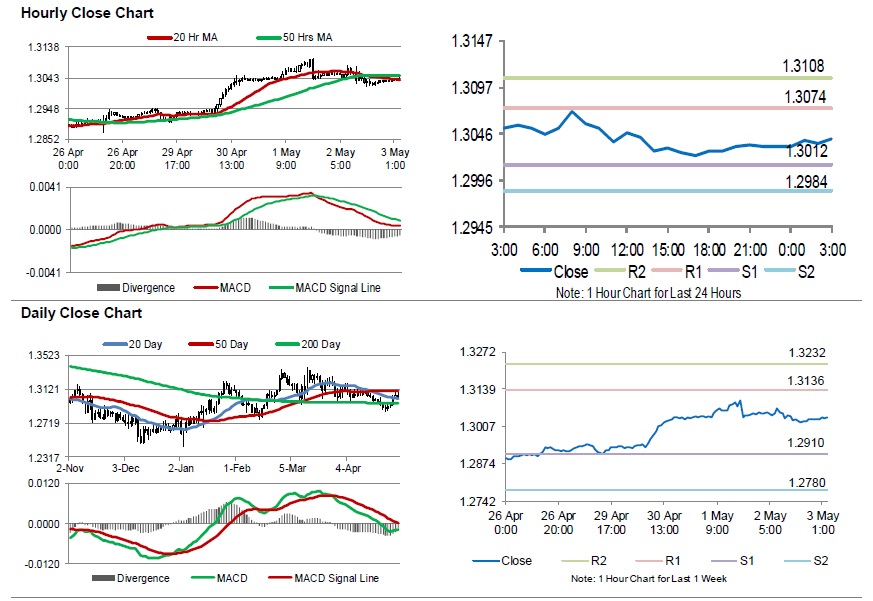

The pair is expected to find support at 1.3012, and a fall through could take it to the next support level of 1.2984. The pair is expected to find its first resistance at 1.3074, and a rise through could take it to the next resistance level of 1.3108.

Trading trend in the Sterling today is expected to be determined by UK’s Markit services PMI for April, set to release in a few hours.

The currency pair is showing convergence with its 20 Hr moving average and trading below its 50 Hr moving average.