For the 24 hours to 23:00 GMT, the GBP declined 9.27% against the USD and closed at 1.1820.

On the data front, UK’s consumer price inflation slowed to 1.7% on a yearly basis in February, driven by motor fuels and computer games and output price inflation and reaching its lowest since mid-2016. In the previous month, inflation had recorded a level of 1.8%. Moreover, the producer price index output declined 0.3% on a monthly basis in February, compared to a rise of 0.3% in the previous month. Additionally, the DCLG house price index rose 1.3% on an annual basis in January, undershooting market forecast for an advance of 2.4% and compared to a revised rise in 1.7% in the previous month. Meanwhile, the retail price index rose 0.5% on a monthly basis in February, in line with market anticipations and compared to a drop of 0.4% in the previous month.

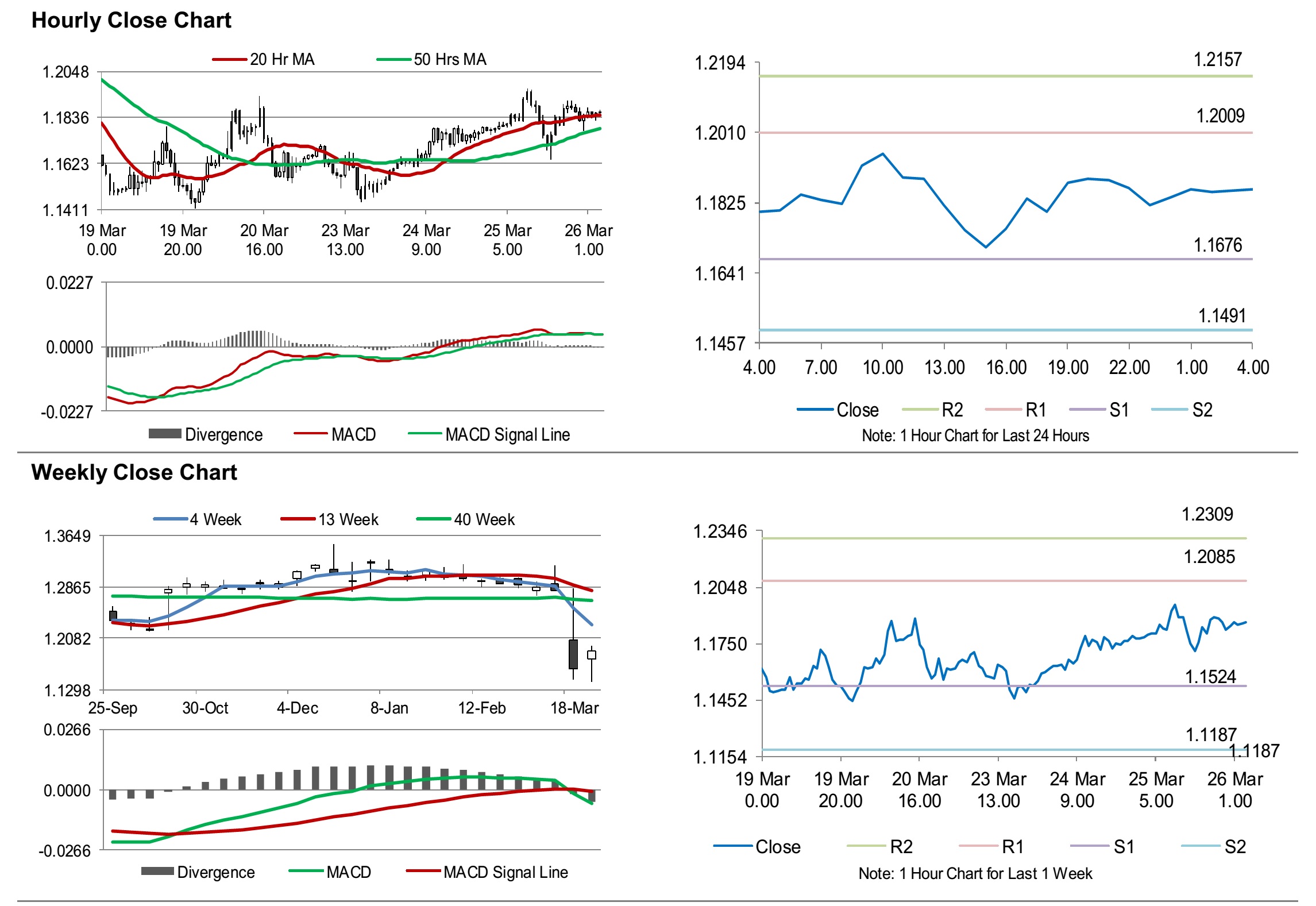

In the Asian session, at GMT0400, the pair is trading at 1.1860, with the GBP trading 0.34% higher against the USD from yesterday’s close.

The pair is expected to find support at 1.1676, and a fall through could take it to the next support level of 1.1491. The pair is expected to find its first resistance at 1.2009, and a rise through could take it to the next resistance level of 1.2157.

Looking ahead, investors would keep a watch on UK’s retail sales for February, slated to release in a few hours. Later in the day, the Bank of England’s interest rate decision and meeting minutes, would keep investors on their toes.

The currency pair is showing convergence with its 20 Hr moving average and trading above its 50 Hr moving average.