For the 24 hours to 23:00 GMT, the GBP declined 4.78% against the USD and closed at 1.2405 on Friday.

On the data front, UK’s Halifax house prices dropped 0.6% on a monthly basis in April, as activities in the real estate market came to a halt after government announced lockdown and compared to a revised fall of 0.3% in the previous month. Additionally, the GfK consumer confidence climbed to -33.0 in April, less than market forecast and compared to a reading of -34.0 in the earlier month.

The Bank of England (BoE), in its interest rate decision, kept its key interest rates unchanged at an all-time low of 0.10% and maintained its bond-buying programme at £645 billion. The central bank held off further stimulus measures but stated that it was ready to take fresh action to counter the coronavirus. Further, the BoE predicted that Britain’s economy was on course to shrink by 25% in the three months to June and by 14% in 2020 with the unemployment rate more than doubling to 9% in the second quarter. The central bank also warned that economy could face its biggest slump in over 300 years in 2020, amid Covid-19 downturn. However, the bank expects the economy to grow by 15% in 2021, with GDP recovering its pre-Covid peak by the second half of next year.

In the Asian session, at GMT0300, the pair is trading at 1.2428, with the GBP trading 0.19% higher against the USD from Friday’s close.

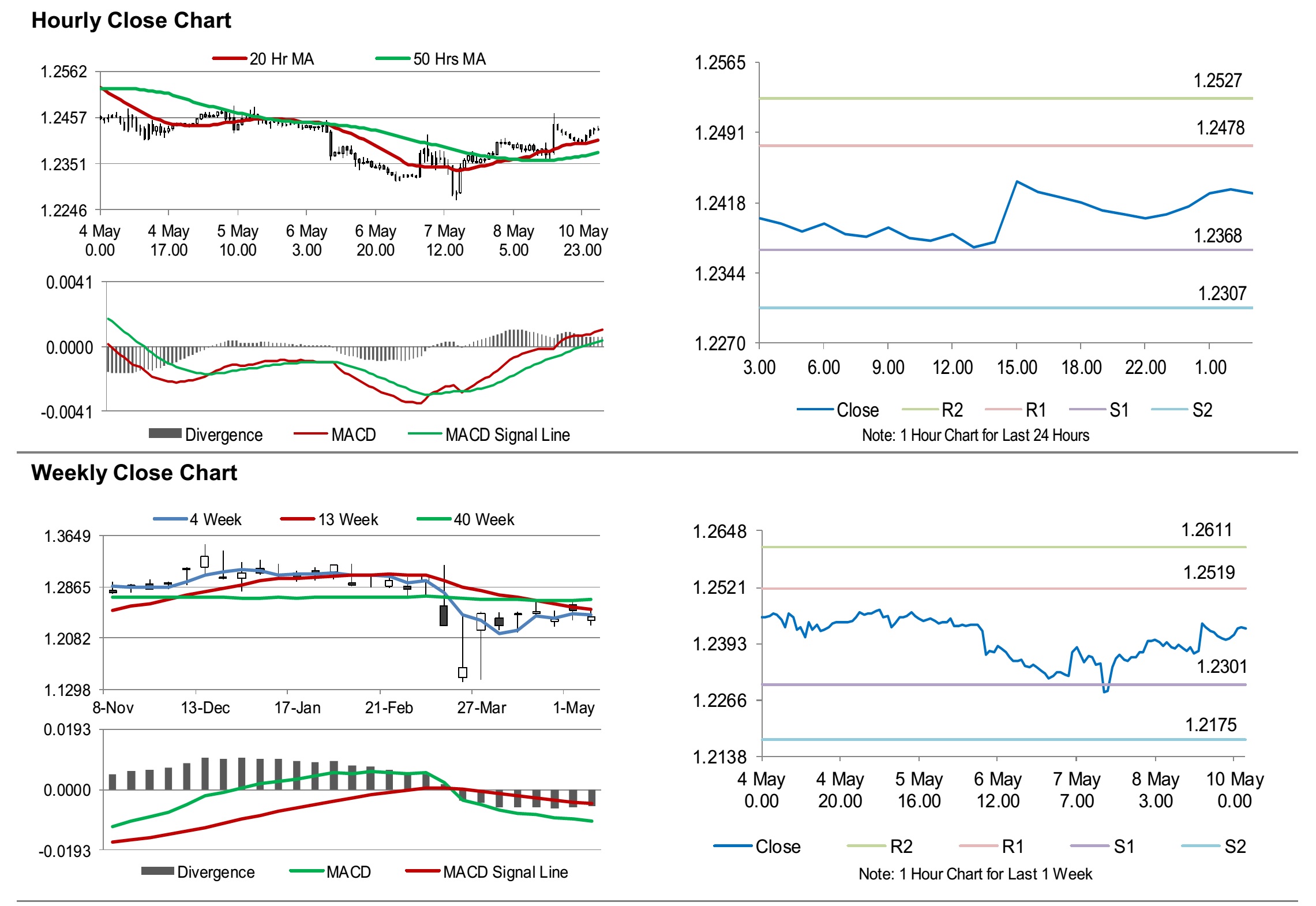

The pair is expected to find support at 1.2368, and a fall through could take it to the next support level of 1.2307. The pair is expected to find its first resistance at 1.2478, and a rise through could take it to the next resistance level of 1.2527.

Amid lack of macroeconomic releases in the UK today, investor sentiment would be determined by global macroeconomic factors.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.