For the 24 hours to 23:00 GMT, the GBP declined 9.49% against the USD and closed at 1.1791, amid weak economic data.

On the data front, UK’s Markit manufacturing PMI dropped to 48.0 in March, less than market forecast for a fall to 45.0 and compared to a level of 51.7 in the prior month. Additionally, the balance of firms reporting total order book above normal dropped less-than-expected to -29.0 in March, compared to a level of -18.0 in the prior month. On the other hand, the preliminary Markit services PMI fell to a level of 35.7 in March, hitting its lowest level since the series began in July 1996 and overshooting market expectations for a fall to a level of 45.0. In the prior month, the PMI had recorded a reading of 53.2.

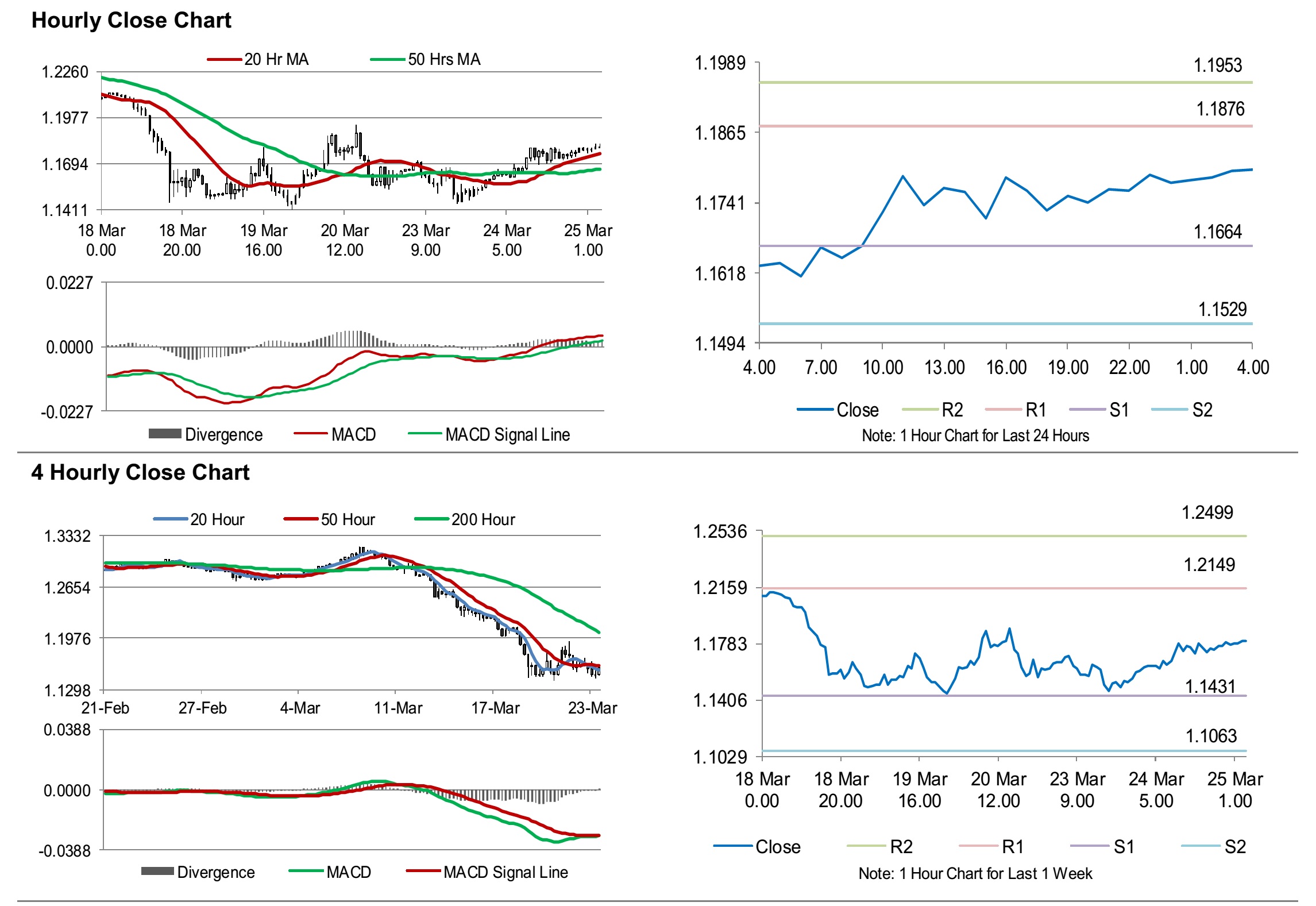

In the Asian session, at GMT0400, the pair is trading at 1.1800, with the GBP trading 0.08% higher against the USD from yesterday’s close.

The pair is expected to find support at 1.1664, and a fall through could take it to the next support level of 1.1529. The pair is expected to find its first resistance at 1.1876, and a rise through could take it to the next resistance level of 1.1953.

Looking ahead, traders would keep a close watch on Britain’s consumer price index, the retail price index, the producer price index, all for February, followed by the DCLG house price index for March, slated to release in a few hours.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.