For the 24 hours to 23:00 GMT, the GBP rose 0.06% against the USD and closed at 1.3209, after data showed UK’s manufacturing sector grew better-than-expected in July.

The Markit manufacturing PMI in the UK expanded more-than-expected to a level of 55.1 in July, as export orders surged to a seven-year high, thus hinting that the nation’s manufacturing sector gathered momentum in the third quarter of 2017. The PMI had recorded a revised level of 54.2 in the previous month, while markets were expecting for a rise to a level of 54.5.

Additionally, the nation’s seasonally adjusted Nationwide house prices unexpectedly rose 0.3% MoM in July, confounding market expectations for a fall of 0.1%. In the previous month, house prices had risen 1.1%.

In the Asian session, at GMT0300, the pair is trading at 1.3201, with the GBP trading 0.06% lower against the USD from yesterday’s close.

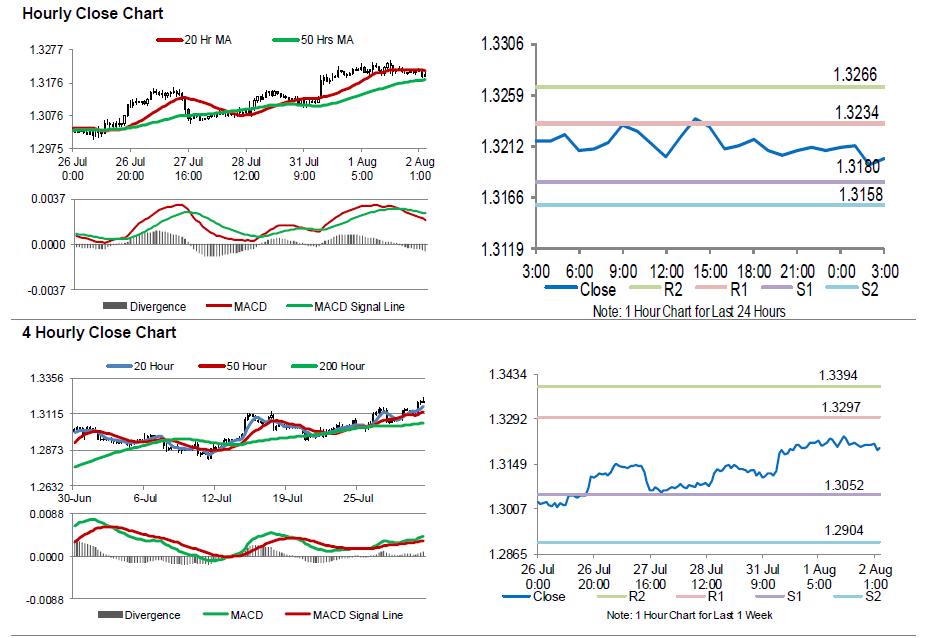

The pair is expected to find support at 1.3180, and a fall through could take it to the next support level of 1.3158. The pair is expected to find its first resistance at 1.3234, and a rise through could take it to the next resistance level of 1.3266.

Moving ahead, market participants will focus on Britain’s Markit construction PMI for July, slated to release in a few hours.

The currency pair is showing convergence with its 20 Hr moving average and trading above its 50 Hr moving average.