For the 24 hours to 23:00 GMT, the GBP declined 5.17% against the USD and closed at 1.2354.

On the data front, UK’s public sector net borrowing deficit widened to £2.33 billion in March, compared to a revised deficit of £0.07 billion in the previous month. Additionally, the Markit manufacturing PMI dropped to 32.9 in April, due to the coronavirus pandemic and hitting its lowest score since the survey began in January 1992. In the previous month, the PMI had recorded a reading of 47.8 in the prior month. Moreover, the Markit services PMI plunged to 12.3 in April, registering its sharpest reduction since the survey began in July 1996 and compared to a level of 34.5 in the earlier month. Furthermore, GfK consumer confidence tumbled to -34.0 in April, compared to a reading of -9.0 in the previous month.

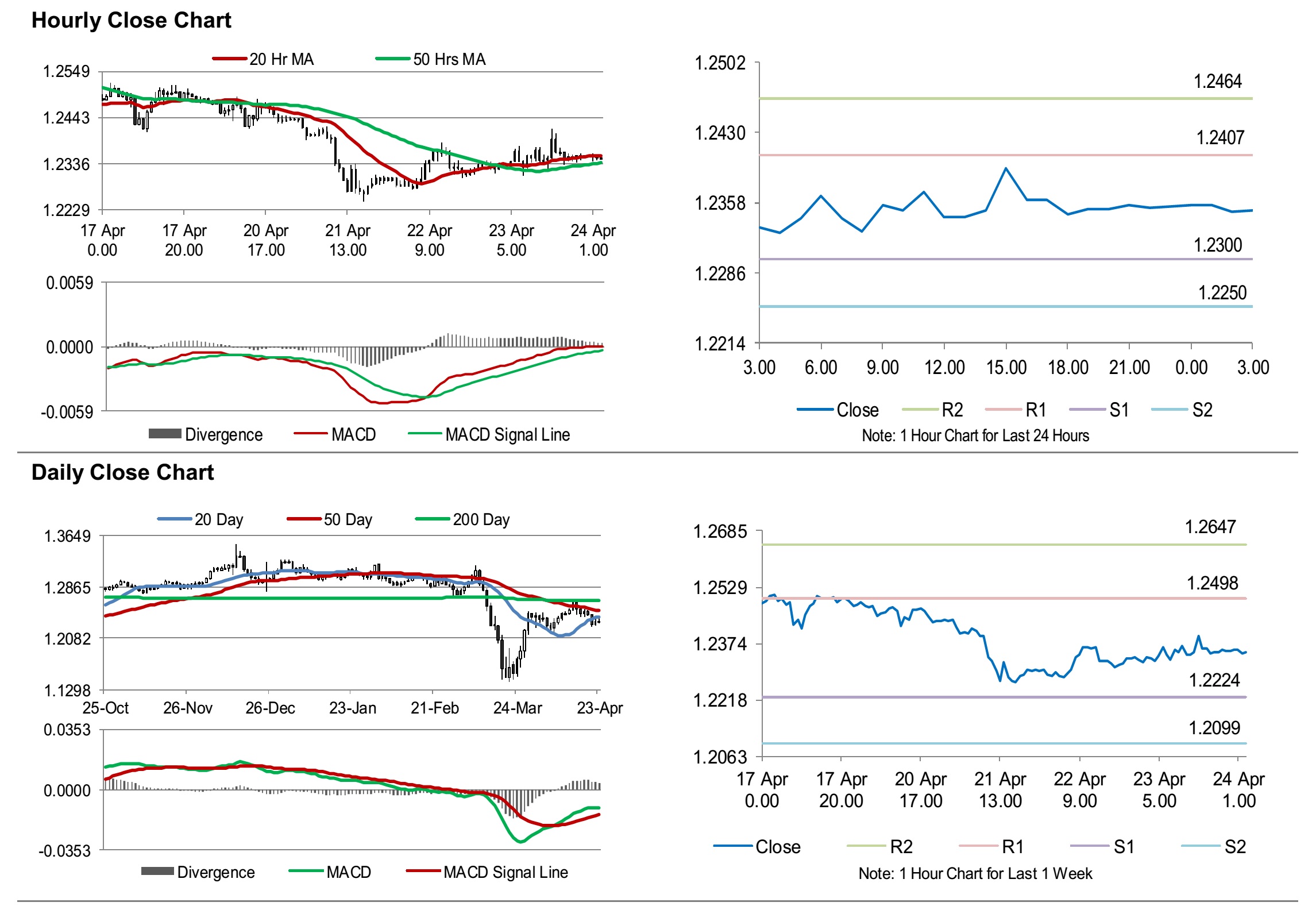

In the Asian session, at GMT0300, the pair is trading at 1.2349, with the GBP trading marginally lower against the USD from yesterday’s close.

The pair is expected to find support at 1.2300, and a fall through could take it to the next support level of 1.2250. The pair is expected to find its first resistance at 1.2407, and a rise through could take it to the next resistance level of 1.2464.

Moving ahead, traders would keep a watch on UK’s retail sales for March, slated to release in a few hours.

The currency pair is showing convergence with its 20 Hr moving average and trading above its 50 Hr moving average.