For the 24 hours to 23:00 GMT, the GBP declined 0.08% against the USD and closed at 1.3036.

Data showed that UK’s public sector net borrowing posted a surplus of £15.8 billion in January, following a deficit of £2.1 billion in the prior month. Market participants had expected the public sector net borrowing to record a surplus of £11.1 billion.

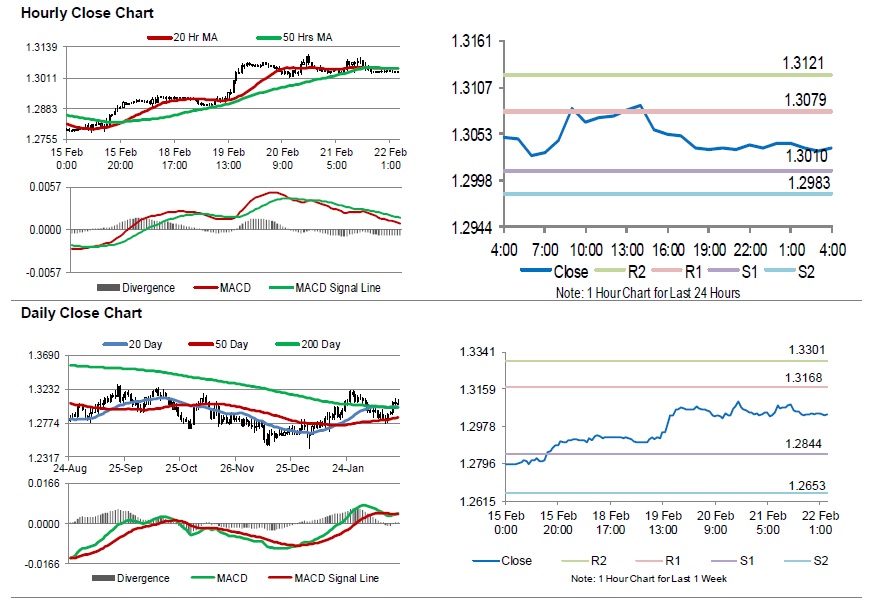

In the Asian session, at GMT0400, the pair is trading at 1.3036, with the GBP trading flat against the USD from yesterday’s close.

The pair is expected to find support at 1.3010, and a fall through could take it to the next support level of 1.2983. The pair is expected to find its first resistance at 1.3079, and a rise through could take it to the next resistance level of 1.3121.

Amid no major economic releases in UK today, investor sentiment would be determined by global macroeconomic factors

The currency pair is trading below its 20 Hr and 50 Hr moving averages.