For the 24 hours to 23:00 GMT, the GBP declined 0.57% against the USD and closed at 1.2411 on Friday, after disappointing retail sales data in the UK pointed towards weakness in consumer spending.

Data indicated that Britain’s retail sales unexpectedly eased 0.3% on a monthly basis in January, as consumers remained reluctant to spend in response to rising inflation. Retail sales registered a revised drop of 2.1% in the previous month, while markets were anticipating for a rise of 1.0%.

In the Asian session, at GMT0400, the pair is trading at 1.2414, with the GBP trading marginally higher against the USD from Friday’s close.

Overnight data indicated that the nation’s Rightmove house price index climbed 2.0% on a monthly basis in February, following a rise of 0.4% in the previous month. Meanwhile, on an annual basis, the index advanced less-than-expected by 2.3% in February, rising at the lowest rate since April 2013 and compared to an advance of 3.2% in the prior month.

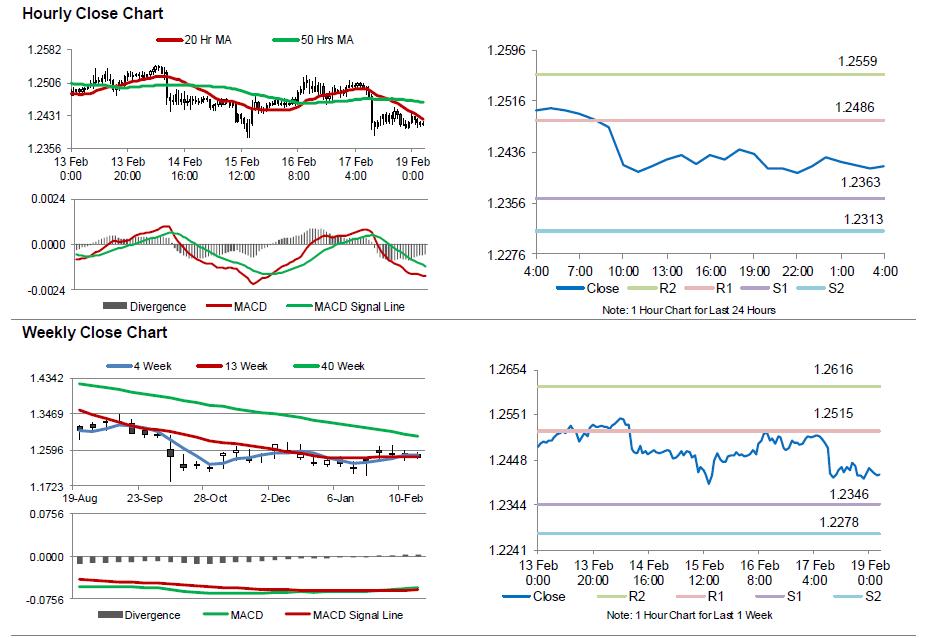

The pair is expected to find support at 1.2363, and a fall through could take it to the next support level of 1.2313. The pair is expected to find its first resistance at 1.2486, and a rise through could take it to the next resistance level of 1.2559.

The currency pair is showing convergence with its 20 Hr moving average and trading below its 50 Hr moving average.