For the 24 hours to 23:00 GMT, the USD declined 1.0% against the CAD and closed at 1.2890.

The Canadian Dollar advanced against the USD, after the Bank of Canada (BoC), at its May monetary policy meeting, hinted that an interest rate hike is around the corner.

The BoC opted to keep the benchmark interest rate steady at 1.25%, as widely expected. Further, the central bank expressed optimism over the Canadian economy on the back of upbeat economic data and added that an interest rate hike would be warranted in the near term in order to keep a lid on soaring inflation.

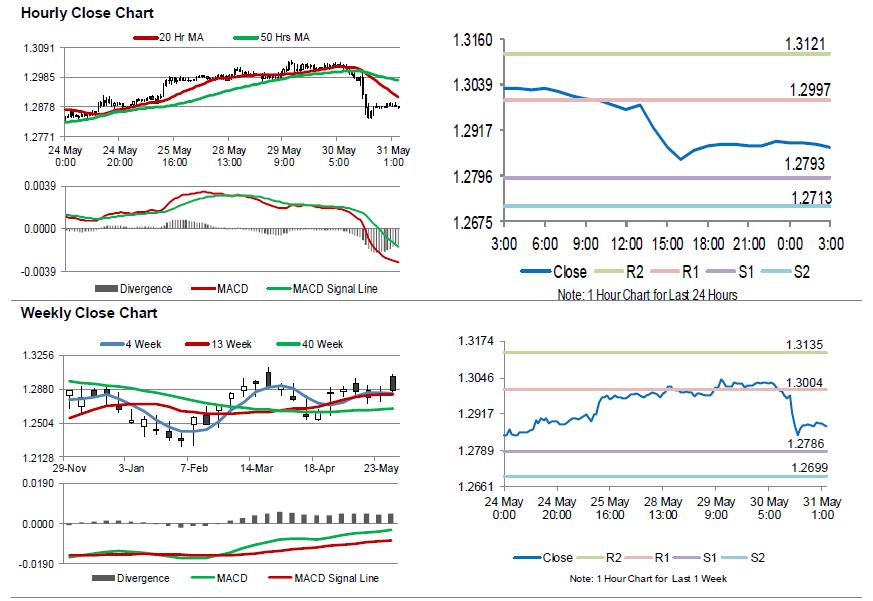

In the Asian session, at GMT0300, the pair is trading at 1.2874, with the USD trading 0.12% lower against the CAD from yesterday’s close.

The pair is expected to find support at 1.2793, and a fall through could take it to the next support level of 1.2713. The pair is expected to find its first resistance at 1.2997, and a rise through could take it to the next resistance level of 1.3121.

Trading trend in loonie is expected to be determined by the release of Canada’s crucial GDP numbers for March, due to be released later in the day.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.