For the 24 hours to 23:00 GMT, the USD marginally rose against the CAD to close at 1.3042.

On the data front, Canada’s RBC purchasing managers’ index (PMI) notched a 2-year high level of 53.5 in January, backed by a pickup in new orders and production volumes. Moreover, this was its 11th successive reading above the 50.0-mark threshold. During the previous month, the index had registered a reading of 51.8.

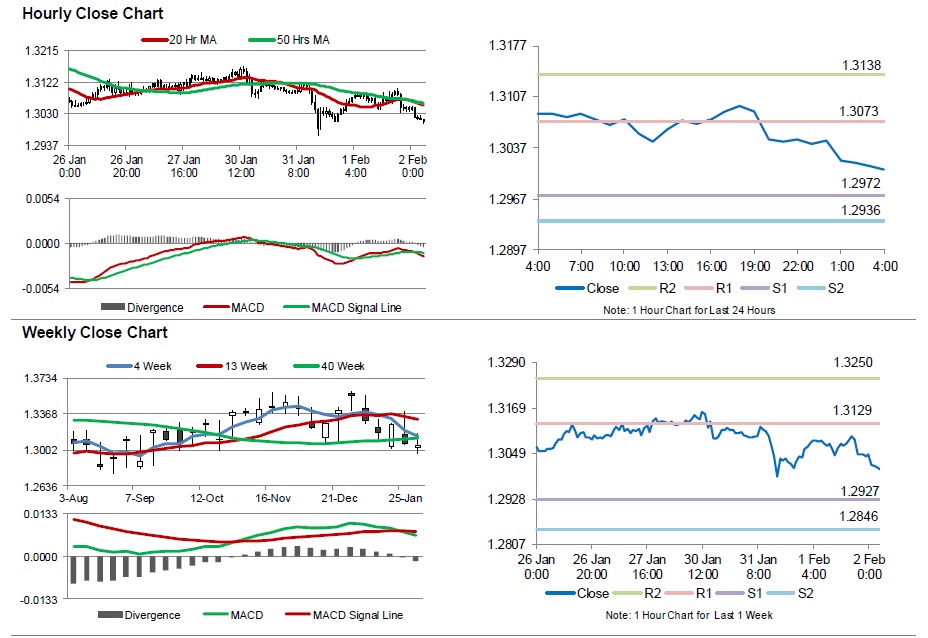

In the Asian session, at GMT0400, the pair is trading at 1.3008, with the USD trading 0.26% lower against the CAD from yesterday’s close.

The pair is expected to find support at 1.2972, and a fall through could take it to the next support level of 1.2936. The pair is expected to find its first resistance at 1.3073, and a rise through could take it to the next resistance level of 1.3138.

With no economic releases scheduled in Canada today, investors await the nation’s Ivey PMI data for January, scheduled to release tomorrow.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.