For the 24 hours to 23:00 GMT, the USD rose 1.15% against the CAD and closed at 1.3139.

The Canadian dollar declined against the US dollar, after dovish Bank of Canada (BoC) meeting.

Data showed that Canada’s consumer price index rose 2.2% on a yearly basis in December, at par with market expectations and compared to a similar rise in the previous month. Additionally, the regions new housing price index climbed 0.2% on a monthly basis in December, compared to a drop of 0.1% in the prior month.

The BoC, in its latest policy meeting kept its benchmark interest rate steady at 1.75%, citing signs of stabilisation and recent positive trade developments. Meanwhile, the central bank downgraded its growth forecast to 1.6% for 2020 and signalled that it could cut interest rates at its next meeting if current slowdown persists.

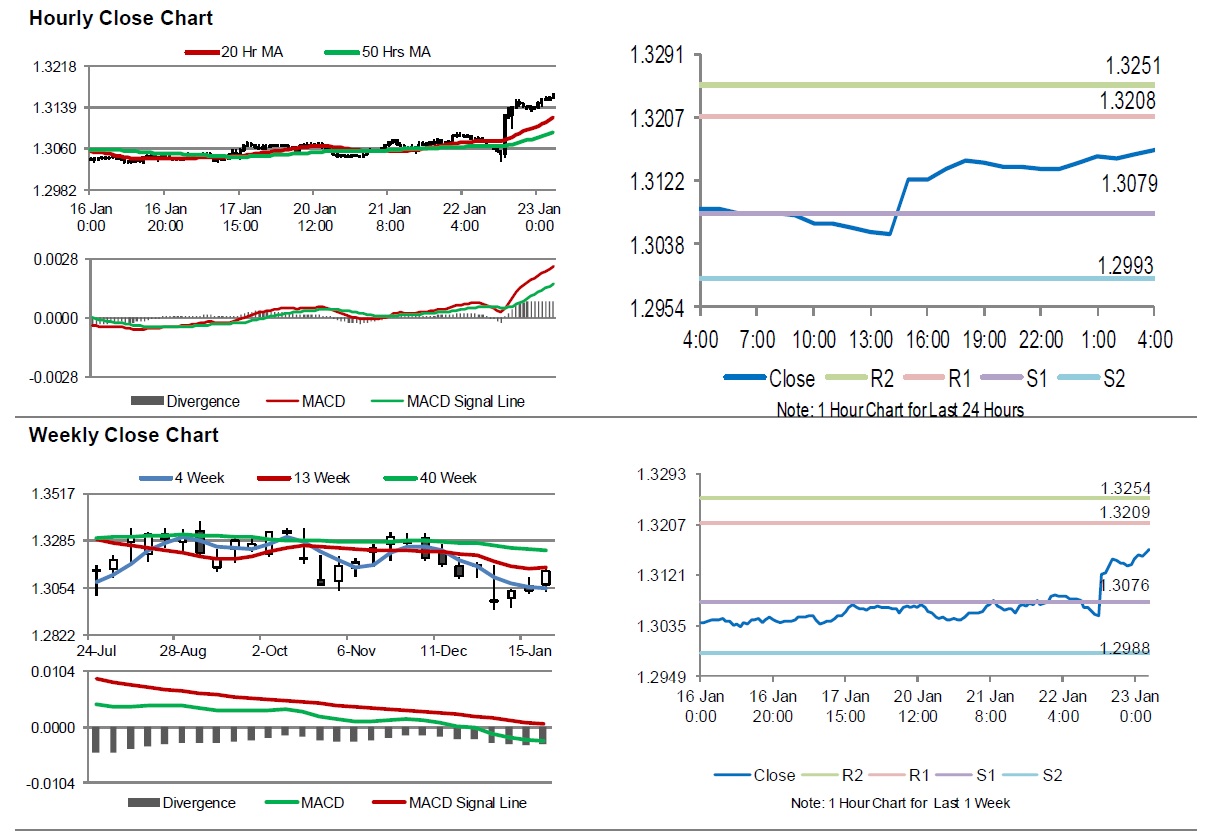

In the Asian session, at GMT0400, the pair is trading at 1.3165, with the USD trading 0.20% higher against the CAD from yesterday’s close.

The pair is expected to find support at 1.3079, and a fall through could take it to the next support level of 1.2993. The pair is expected to find its first resistance at 1.3208, and a rise through could take it to the next resistance level of 1.3251.

In absence of any macroeconomic releases in Canada today, investor sentiment would be governed by global macroeconomic factors.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.