For the 24 hours to 23:00 GMT, the USD traded marginally lower against the CAD to close at 1.2198.

Yesterday, an former adviser to the earlier Bank of Canada Governor Mark Carney, stated that the BoC may cut interest rates to zero in the coming six to eighteen months, as an elevated Canadian dollar puts the nation’s economic recovery at risk.

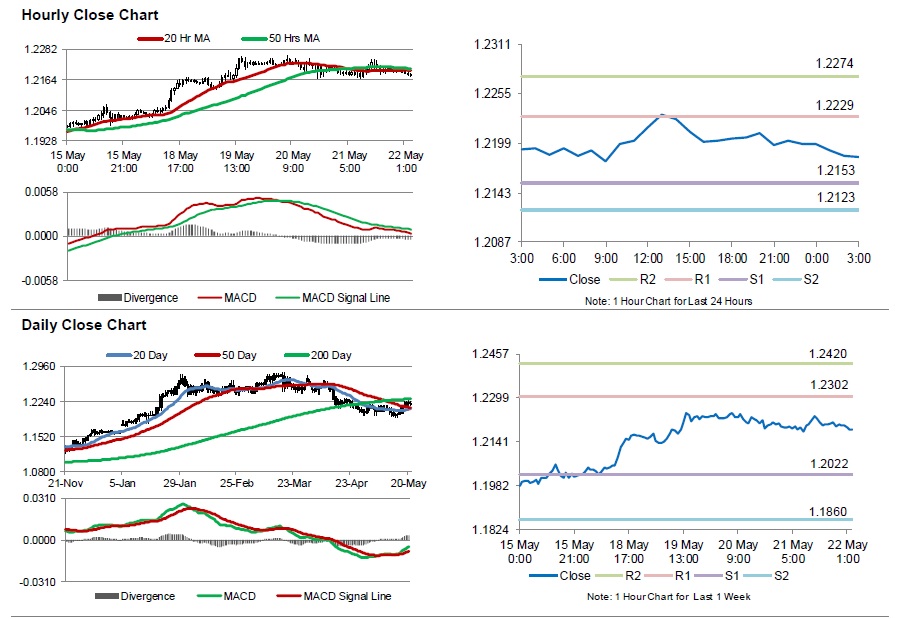

In the Asian session, at GMT0300, the pair is trading at 1.2184, with the USD trading 0.12% lower from yesterday’s close.

The pair is expected to find support at 1.2153, and a fall through could take it to the next support level of 1.2123. The pair is expected to find its first resistance at 1.2229, and a rise through could take it to the next resistance level of 1.2274.

Going forward, market participants will keep a tab on Canada’s inflation as well as retail sales data, scheduled later today for further direction in the pair.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.