For the 24 hours to 23:00 GMT, the USD declined 0.20% against the CAD and closed at 1.3208.

Data revealed that Canada’s seasonally adjusted housing starts fell to a level of 213.4K in December, compared to market anticipations for a drop to a level of 205.5K. In the prior month, housing starts had recorded a revised level of 224.3K.

The Bank of Canada, in its monetary policy meeting, opted to leave its key interest rate unchanged at 1.75%, as widely expected. However, the central bank lowered its 2019 growth outlook to 1.7% from 2.1%, signalling a slower expansion in the economy.

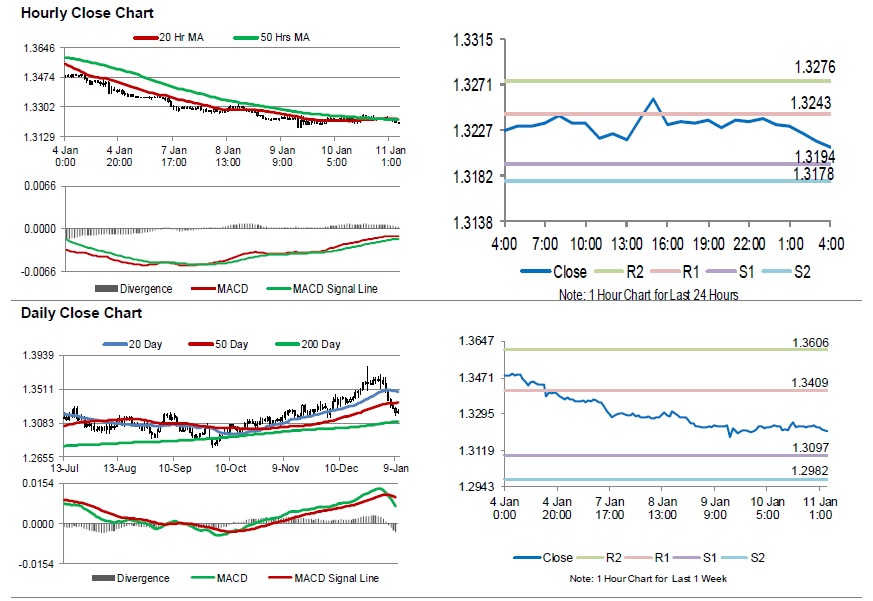

In the Asian session, at GMT0400, the pair is trading at 1.3227, with the USD trading 0.14% higher against the CAD from yesterday’s close.

The pair is expected to find support at 1.3189, and a fall through could take it to the next support level of 1.3150. The pair is expected to find its first resistance at 1.3257, and a rise through could take it to the next resistance level of 1.3286.

Trading trend in the Loonie today is expected to be determined by Canada’s new housing price index and building permits, both for November, set to release later in the day.

The currency pair is showing convergence with its 20 Hr moving average and trading below its 50 Hr moving average.