For the 24 hours to 23:00 GMT, the USD declined 0.15% against the CHF and closed at 0.9937.

In economic news, Switzerland’s producer and import price index dropped 0.8% on an annual basis in May, more than market expectations for a fall of 0.7%. The index had recorded a decline of 0.6% in the previous month.

The Swiss National Bank, in its latest monetary policy meeting, opted to leave its key interest rate steady at -0.75%, as widely expected and indicated that the central bank would hold its ultra-loose monetary policy unchanged till 2021.

In major news, the State Secretariat for Economic Affairs’ (SECO), in its June economic forecasts upgraded its 2019 economic growth forecast to 1.2% and maintained its 2020 growth outlook of 1.7%, however, the agency warned over risk of global trade war.

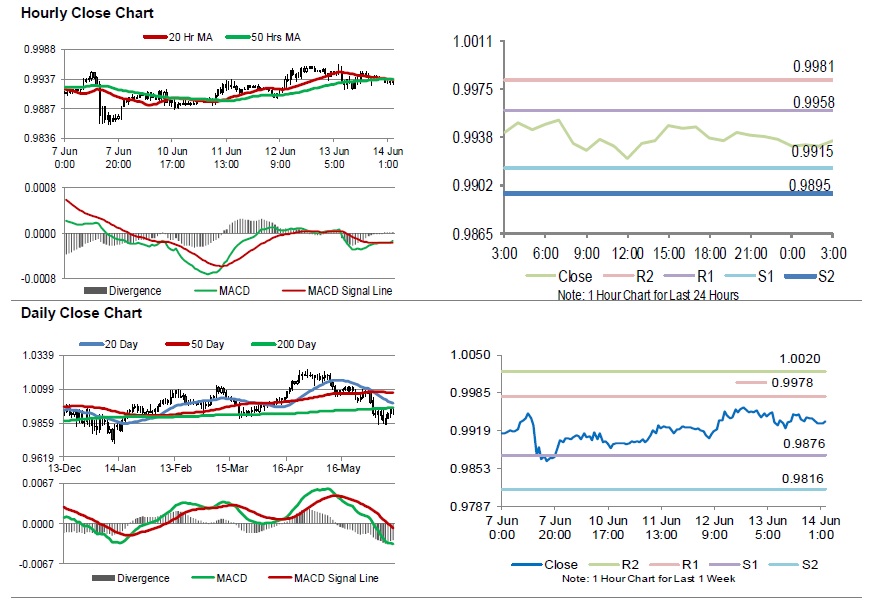

In the Asian session, at GMT0300, the pair is trading at 0.9935, with the USD trading marginally lower against the CHF from yesterday’s close.

The pair is expected to find support at 0.9915, and a fall through could take it to the next support level of 0.9895. The pair is expected to find its first resistance at 0.9958, and a rise through could take it to the next resistance level of 0.9981.

With no macroeconomic releases in Switzerland today, investors would look forward to global macroeconomic releases for further direction.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.