For the 24 hours to 23:00 GMT, the USD declined 0.11% against the CHF and closed at 0.9939.

Yesterday, the Swiss National Bank (SNB) Chairman, Thomas Jordan, stated that the central bank could cut its negative interest rates even more, if found necessary. He also added that negative interest rates are appropriate for now despite the risks associated with it, citing significant overvaluation of Swiss Franc and globally low interest rates.

In other economic news, Switzerland’s total sight deposits inched up to a level of CHF518.5 billion in the week ended 21 October, from CHF518.2 billion in the previous week.

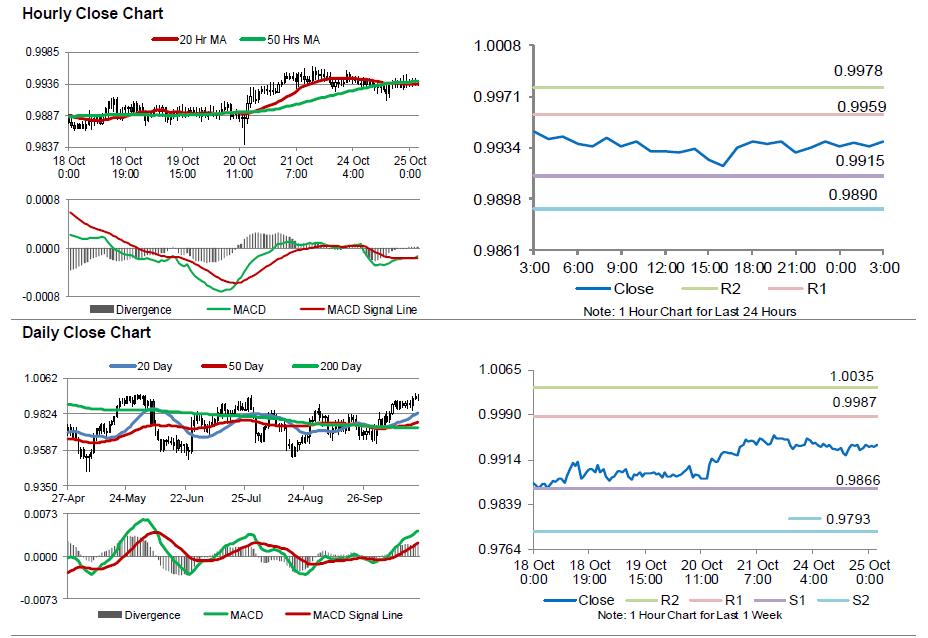

In the Asian session, at GMT0300, the pair is trading at 0.9939, with the USD trading flat against the CHF from yesterday’s close.

The pair is expected to find support at 0.9915, and a fall through could take it to the next support level of 0.989. The pair is expected to find its first resistance at 0.9959, and a rise through could take it to the next resistance level of 0.9978.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.