For the 24 hours to 23:00 GMT, the USD rose 0.75% against the JPY and closed at 112.36, after the US Fed hinted that it would consider a further tightening of monetary policy this year.

In the Asian session, at GMT0300, the pair is trading at 112.47, with the USD trading 0.1% higher against the JPY from yesterday’s close.

Earlier today, the Bank of Japan (BoJ), as widely expected, left its key interest rate steady at -0.1% and pledged to continue its asset-buying programme. Further, the central bank maintained its optimistic view of the economy, signalling its confidence that a solid recovery will eventually push inflation towards its 2.0% target without additional stimulus.

On the macro front, Japan’s all industry activity index dropped 0.1% on a monthly basis in July, meeting market expectations. In the prior month, the index had recorded a revised rise of 0.2%.

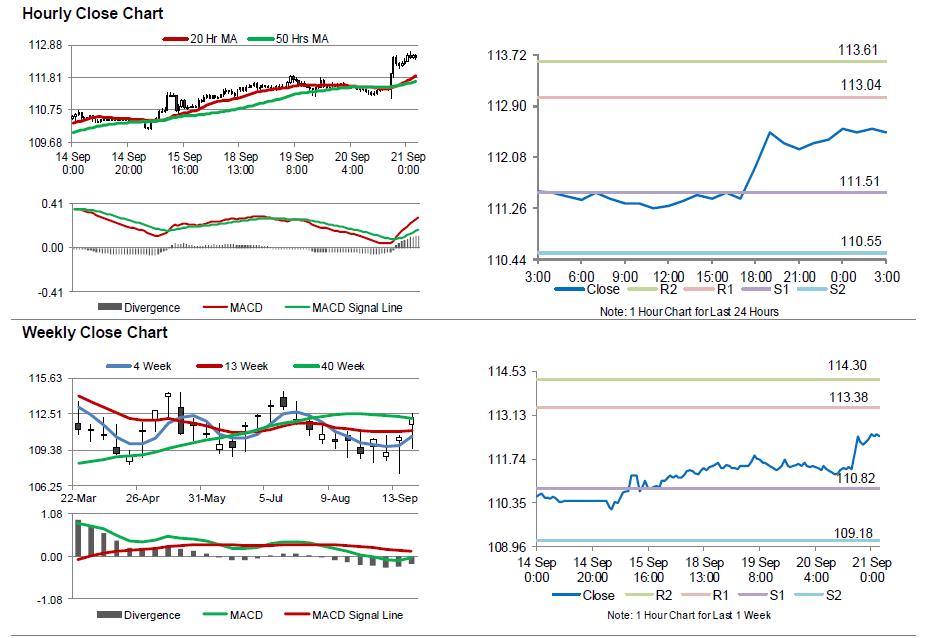

The pair is expected to find support at 111.51, and a fall through could take it to the next support level of 110.55. The pair is expected to find its first resistance at 113.04, and a rise through could take it to the next resistance level of 113.61.

Looking ahead, investors anxiously await for comments from the BoJ Governor, Haruhiko Kuroda, to get cues on the central bank’s monetary policy outlook.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.