For the 24 hours to 23:00 GMT, the USD marginally rose against the JPY and closed at 111.19.

In the Asian session, at GMT0300, the pair is trading at 111.06, with the USD trading 0.12% lower against the JPY from yesterday’s close.

The Japanese Yen gained ground against the USD, after Japan’s unemployment rate fell more-than-expected to 2.8% in June, as job availability improved further, boosting optimism over the health of the nation’s labour market. In the past month, the nation’s unemployment rate had registered a reading of 3.1%, while market participants had expected it to fall to 3.0%. Meanwhile, the nation’s national consumer price index (CPI) rose 0.4% on an annual basis in June, at par with market expectations. In the prior month, the CPI had registered a similar rise.

Another set of data revealed that Japan’s seasonally adjusted retail trade rebounded 0.2% in June, compared to a fall of 1.6% in the previous month. Markets were anticipating retail trade to advance 0.4%. Moreover, the nation’s large retailers’ sales registered an unexpected rise of 0.2% in June, defying market consensus for a fall of 0.1% and following decline of 0.6% in the prior month.

Separately, the Bank of Japan’s (BoJ) summary of opinions report from its July meeting showed that policymakers discussed repeated delays in meeting the central bank’s inflation target and that it could undermine the BoJ’s credibility. Also, they called for an in-depth discussion on whether it was appropriate to continue buying exchange-traded funds.

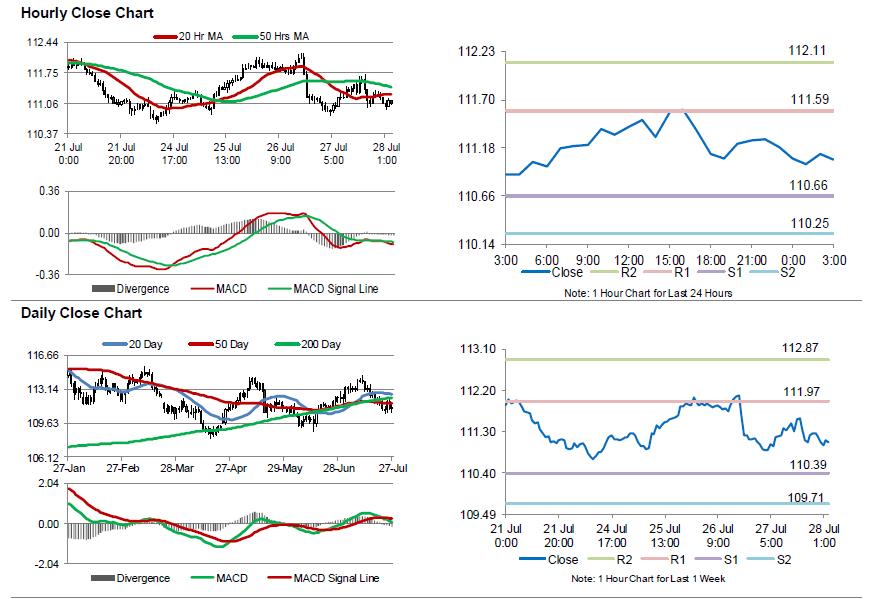

The pair is expected to find support at 110.66, and a fall through could take it to the next support level of 110.25. The pair is expected to find its first resistance at 111.59, and a rise through could take it to the next resistance level of 112.11.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.